Before we jump into the core area of this post, let’s just glance through some fundamental driving forces. The oil performance has been instrumental in boosting the Canadian currency so far in conjunction with the BoC’s rate hiking speculations.

Even though the long-term picture suggests that the currency has overshot the rebound in oil prices. However, the CAD is on the right track to remain strong: the interest rates factor is taking over from the commodity factor. CAD rates recently climbed above USD rates for the first time since 2014, and our USD rates projections can realistically drag the USDCAD to 1.35. Since February 20115, the pair has been oscillating between 1.4689 on north and 1.2037 on the south.

In this write-up, we emphasize to take advantage of high carry-to-vol, with the Fed in a slower gear than the markets expected here we widen the net by employing no-touch structures as a passive play on limited upside in high beta FX. No-touches can be seen as defined downside alternatives to selling naked vanilla high beta & EM puts and are well suited to take advantage of the modestly risk-positive environment that should emerge after the trade dust settles.

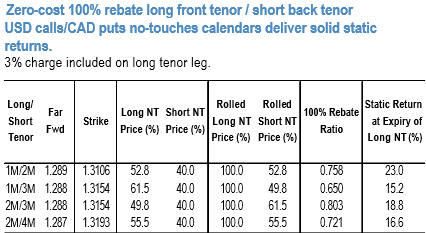

As shown in the above nutshell, one can configure calendar options structures that come in costless, buying front tenor no-touch (NT) and selling back tenor NT with the same barrier and notional adjusted to assure zero loss in event of the barrier getting triggered.

At the current market, the strategy collects solid static returns in case of USDCAD (+1M/-2M 23% of the 2M leg notional of static return –i.e. if spot stays unchanged after 1M –at expiry of the long no-touch leg).

With CAD at the moment out of the trade crosshairs, consider the following as a low-cost slow Fed play: Long 1M vs. short 2M USDCAD call no-touch calendar @1.3150, in 0.8:1.0 ratio notionals, spot ref 1.2929 costs 4.8% USD.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist