In this Commodities Watch, we present to our readers, the performance of commodities, which in turn decide the wellbeing of many commodity producing and consuming nations. For example, India is a major consumer of oil, so if the price goes higher, it may drag the country’s trade balance as it imports most of its consumption.

We, at FxWirePro, have been sensing a change in tide in the commodities market, which is of utmost importance to keep a tab on. Why?

Historically speaking, a rise in commodity prices has triggered a vicious chain reaction. First, the prices of commodities go up, which in turn triggers a rise in inflation, which again has historically triggered selloffs in bonds, which has not been good for equities sometimes. In a world, where central banks have provided unprecedented stimulus, the rise in inflation in the biggest possible threat.

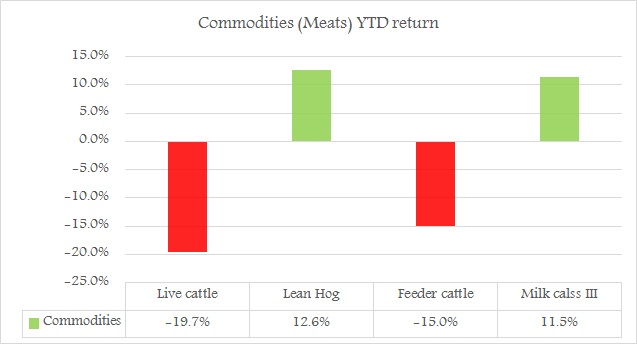

In this article, we evaluate the YTD performance of the Meats and products, which are consumed in large parts of the world.

- In this pack, Lean hogs have been the best performer with 12.6 percent YTD gains, followed by Class III Milk (11.5 percent).

- Live and Feeder cattle remains terrible performers with 19.7 percent and 15 percent YTD loss respectively.

This group is the worst performer among all the commodities with 2.7 percent YTD loss on an average.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022