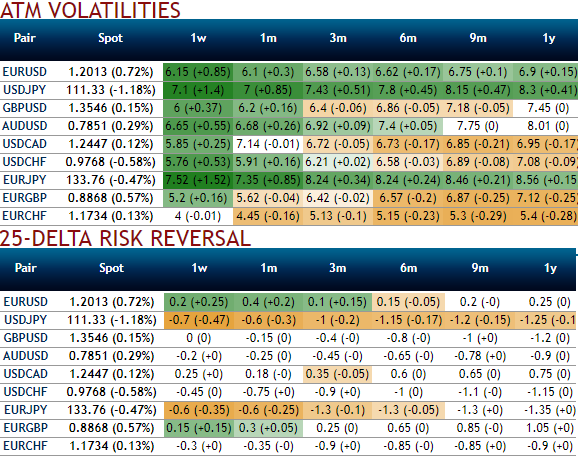

The global picture on the volatility front hasn’t really changed in recent months. Implied and realized volatility is still hovering in their low or very low percentiles.

The currency market has been acting as the adjustment factor between countries positioned at different parts of the economic cycle clock. Please refer above nutshell that evidences depressed volatility keeping entry costs low while uncertainty is still lingering the probability of a positive return. Japan and core euro zone are our preferred markets.

It has been one of the few assets on which carrying long volatility positions has not been a constant pain. It has also led to a dramatic reversal in the correlation regime, leading to some significant discounts on equity options contingent to currency levels.

The fundamental motivation for owning GBP volatility was straightforward and colored by uncertainty on multiple fronts – around the Brexit process, increasingly dysfunctional domestic politics, continued debate around the abrupt change in the BoE’s reaction function and the risk of an unwind of rate hikes priced along the yield curve should growth and/or politics intercede.

With current levels of implied vols still low, we continue to find value in holding this trade.

Long a 1Y vol swap in EURGBP. Opened at 8.85%November 21. Marked at 8.15%.

Elsewhere, even though not explicitly an Outlook 2018 theme, we had spotted out and highlighted the luring factor of owning CAD-denominated correlations, specifically CADUSD vs CADJPY as a positive carry NAFTA hedge in December. CAD and MXN have already proven relative outperformers since then amid the broad-based softness in vols elsewhere (refer above chart), which allied with the collapse in USDJPY vol has helped this trade: realized CADUSD – CADJPY corrs have clocked almost 20 points over implieds since publication, and there is value still to be extracted from CADJPY vs USDJPY vol spread.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential