The US continues to lag the growth upgrade cycle, prompting yet another 2% downgrade to the USD TWI forecast. Following some up and down, yesterday was a quiet day for the US currency. The ICE’s USD index traded in a range of 91.75 / 92.10. Even though the data due for publication today, the producer prices (PPI), affect inflation development and thus provide information for the market outlook on the Fed and the USD development we nonetheless do not expect the market to react to the data.

The USD rebound appears to be stalling and if the rally is to gain any further traction, it will need help from the US data (CPI and retail sales data due Thursday and Friday respectively) to give US yields an additional boost and light a fire under Fed Dec rate hike expectations.

On the flip side, SNB is scheduled for its Libor rate announcement on Thursday and you can foresee bearish scenarios of CHF given the fact that SNB resumes FX intervention at higher spot rates than previously and can be bullish if SNB desists from intervention over a multi-month period. Potential trigger events are SNB intervention (weekly sight depos, monthly stats, P&L on Swiss reserves).

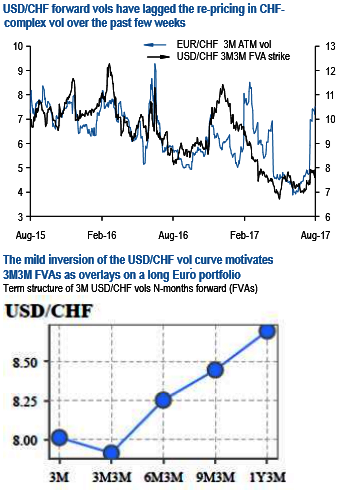

USDCHF 3M3M FVAs have lagged the upturn and are value buys along a mildly inverted curve. Holding USDCHF vol appeals because it can benefit from the full gamut of risk triggers that can afflict all USD-vols, is a useful hedge overlay on a bullish Euro macro portfolio, and retains exposure to idiosyncratic CHF weakness of the kind seen recently, all without the threat of overt SNB management that can frustrate outsized sell-offs in EURCHF.

The FVA format is motivated in part by the fact that USDCHF forward vols have severely lagged the surge in CHF-complex gamma (refer above chart), and partly by the mild inversion of the vol curve that ensures optically appealing flat slide/roll over time (refer above chart).

Admittedly some of the term structure shape is due to the forward starting 3M window covering the quiet holiday weeks of late December (3M3M = mid-November’17 to mid-February'18) that depresses 6M vol, but despite that, it may not be the worst idea to take delivery of and own USDCHF straddles through the first half of December that can reprise the above-average volatility of previous years around ECB and Fed meetings when tapering and rate hike decisions are expected to be announced.

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics