Copper (XCU/USD) prices have been edgy at 3.2978 levels as it makes sense for sellers to take control and drive the market into the objective at $3.1325 to $3.0880 where this area is a demand zone and a test of it will probably bring in new buyers. It is the Chinese demand which is driving the copper price crazy.

While the physical market slowed into year-end, western funds and money managers turned increasingly bullish across the complex, boosting their net long positions in LME copper, aluminum, nickel, and zinc over the last two weeks of 2017. In aluminum, money managers increased their net long LME position by nearly 570 kmt from December 15th through the 29th, bringing it to more than 4 mmt, the highest level in more than six months. This helped 3M LME prices rise nearly 10% over that same time period, compared to only a 6% rise in SHFE prices.

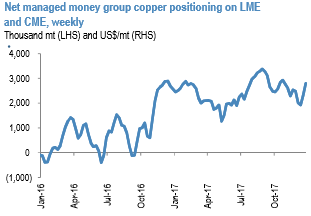

In copper, reversing relatively steady declines through November and the beginning of December, combined net long managed money positioning on the LME and COMEX increased more than 870 kmt in the last two weeks of data to nearly 2.8 mmt (refer above diagram).

The growth reflects a low base, sales momentum could be sustained into January given that Chinese New Year falls in mid-February this year compared to late-January last year.

As the physical market slowed into year-end, western funds and money managers turned increasingly bullish across the complex, boosting their net long positions in LME copper, aluminum, nickel, and zinc over the last two weeks of 2017.

To address this, the PBOC announced a temporary RRR facility agreement which should release up to about RMB 2 trillion of liquidity into the bank system around the Chinese Lunar New Year (Feb 15-21).

While headlines of closures of Chinese smelting capacity underpinned bullish price action, in our view, as of end-December both Jiangxi Copper and Tongling Nonferrous were still operating at normal rates.

The dollar: The US dollar ended 2017 on a bit of a downbeat note, despite solid growth, Fed tightening and the passage of the US tax bill through Congress. The trade-weighted index is heading towards the worst start of the year since 2015, approaching new three-month lows (Exhibit 3). Relatedly, both the Euro and RMB continue to surge against the dollar and are hitting fresh multi-year highs, reaching 1.2073and 6.4935, respectively.

After several rounds of negotiations and despite considerable differences in opinion, the 2018 benchmark smelters during December and January under pressure from local authorities in Anhui province to reduce pollution. Henan province has also ordered some smelters, including China Gold and Yuguang, to cut production by 30% during high pollution days.

Also, some secondary smelters in Shandong and Hebei were asked to reduce production by half during the winter heating season. While the headlines underpinned bullish price action, as of end-December both Jiangxi Copper and Tongling Nonferrous were still operating at normal rates. Additionally, some primary smelters (Dongying Fangyuan and Heding Copper), which have operated at reduced rates in the first half of the year, have actually increased production in 4Q.

Elsewhere, there are signs that the scrap supply in the Chinese spot market has become tight partly because of the low scrap imports in 4Q’17. Among base metals, copper has been steady at $3.223 a pound.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise