Ongoing data surprises mean forecast upgrades forthcoming in next week’s Monetary Policy Report.

The data flow from Canada, similar to what has been seen globally, has surprised almost persistently since last September (refer above diagram).

Our economists have raised their own 1Q GDP growth forecast to 3.8% and have penciled a first BoC’s hike in 3Q18. BoC will likely have to make similar upside revision both global and its own Canada forecasts – the January MPR it estimated 4Q16 and 1Q17 at 1.6% and 1.5%yoy respectively compared to an actual 2% in 4Q and a January 2.3% print (refer above diagram).

Meanwhile, BoC's 1Q17 projection for headline inflation was 1.8% versus actual inflation in first two months of the year which averaged 2.0%.

But this is unlikely to shift BoC away from its dovish stance. This begs the question whether the forthcoming forecast upgrades will shift the BoC stance in a meaningful way for CAD; we think unlikely, in the near-term at least. First, is simply the stubborn dovish persistent rhetoric over the past month from BoC Gov Poloz and other senior officials, as recently as last week downplaying the strength of recent headline data, emphasizing still-sizable excess capacity, downside risks, and warning against expectations that BoC would mirror the Fed in the US’s policy normalization cycle.

Hedging Strategies:

We recommend initiating longs in 2 lots of 2M ATM +0.51 delta call and simultaneously short 1 lot of OTM call (1%) with comparatively shorter expiry (preferably 2w) in the ratio of 2:1.

So, trading option spreads in different strikes allows the traders in many tricky market scenarios and likely to fetch positive cash flows.

The lower strike short calls seems little risky but because IV responds adversely, the likelihood of options expiring in the money is very less and it finances the purchase of the greater number of long calls (ATM calls are reasonably priced, so we loaded up with the weights in the spreads) and the position is entered for reduced cost.

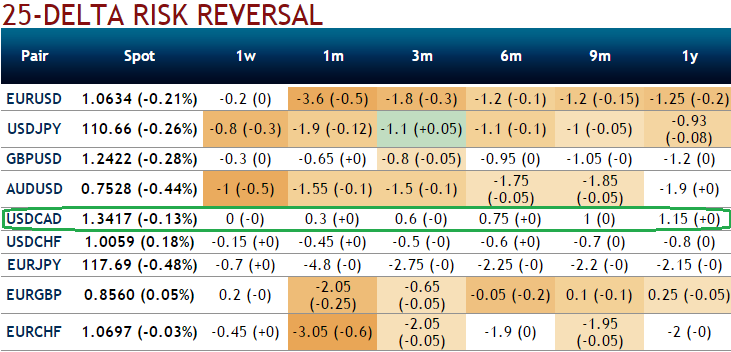

Rationale: Please be noted that it seems to be ideal time for the writers of overpriced call options as you could observe the negative shift in risk reversal flashes in 1m tenors, whereas we see neutral changes to the mild bullish risk sentiments across all tenors, as a result, CAD seems to be losing its strength in next 2 months tenor, on the contrary, USD’s robustness in Q2 on fed’s hiking hopes June meeting seems more attractive than CAD.

Moreover, all these factors are discounted in FX options market, you could observe this in implied volatility skewness.

You could make out this in mounting upside risk sentiments as you could see the positively skewed IVs in OTM call strikes. Hence, long positions in ATM instruments seems attractive for holders of the calls as the Vega is generally larger in options which have the longer time until expiry, and it falls as the option approaches expiry.

This is because an increase in IV is more beneficial for a longer term option than for an option that would expire in shorter tenors.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges