Canadian central bank (BoC) is scheduled for their monetary policy on September 4th. A resurgence of global fears from weak cyclicals and renewed trade war risk reversed most of CAD’s Q2 strength against the dollar. USDCAD has rebounded 2.5% from mid-July lows of just above 1.30 back above 1.33, on the back of broad dollar strength as global trade war risks re-intensified and global recession fears rose.

Bullish USDCAD scenarios, see above 1.35 if:

1) NAFTA withdrawal;

2) The US falls into recession and spills over globally;

3) BoC as aggressively as the Fed, rewidening rate spreads beyond 65bps

Bearish USDCAD scenarios, see below 1.25 if:

1) Fed cuts more aggressively than expected;

2) BoC does not follow the Fed and holds rates indefinitely;

3) Ratification of USMCA and end to US-China trade conflict

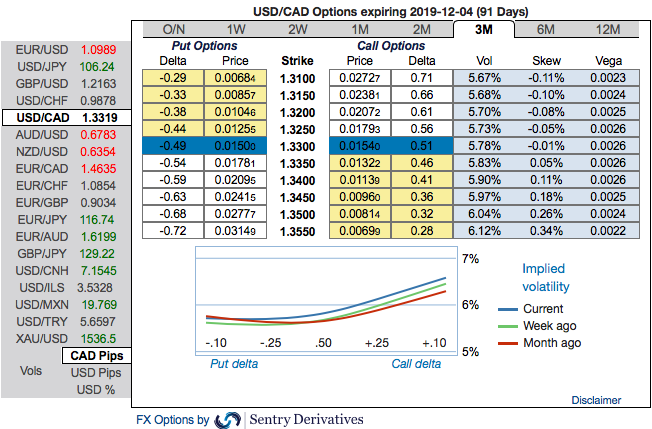

Options Trades Recommendation: At spot reference: 1.3320 level while articulating, we advocate diagonal debit call options spreads foreseeing both mild downswings in the near-terms and the major uptrend. Positively skewed IVs of 3m tenors are indicating upside risks with OTM bids up to 1.3550 level.

While bullish neutral risk reversal numbers substantiate this bullish stance coupled with 3m skews that are indicating the upside risks.

Well, contemplating above driving forces and OTC updates, diagonal call spreads as preferred option structures seem the best suitable under prevailing circumstances given elevated skew and favourable cost reduction.

Execute USDCAD 3m/2w call spread strategy (strikes 1.32/1.35) for a net debit.

The rationale: Firstly, as you could observe the underlying spot of USDCAD has dipped somewhat in the minor trend below 1.32 level with exhausted bullish sentiments from recent past or so, hedgers’ interests remained intact onto the bullish neutral risk reversals in longer tenors along with shrinking IVs (implied volatilities).

Short calls are most likely to expire worthless, so that the option writer can be rest assured with the initial premiums received.

Secondly, One should understand the prime intricacy of choosing ITM call which is that such options with strike prices close to the price of the underlying spot tend to have the highest risk premium or time-value built into the option prices. This is compared to deep in the money options that have very little risk premium or time-value built into the option price.

Thereby, one can achieve hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

Favour optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

Maintain the net delta of the position above 70% as shown in the above nutshell and shorting the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25% as you could see skews of 2w tenors are well-balanced on either side. Source: Sentrix, JPM & Saxobank

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays