Take a quick glance at some key fundamentals: As we continue to foresee the trade apprehensions ratchet up, the GBPUSD likely to prolong its apprehensions amid minor spikes in a typical “risk off” move.

While the bearish sentiments remain intact OTC markets. While Theresa May danced around the tricky details of Brexit in her concluding speech. Comments like “honouring the result of the referendum”, “seek a good trading and security relation” and Great Britain was not afraid to leave without a deal were met by enthusiastic applause. She dodged the word “Chequers plan”. With the exception of some sentences on Brexit, May focussed on other issues in her speech. As a result, her comments have to be seen in the context of her trying to appease the hardliners with boastful comments on domestic politics: they were not aimed at the EU. The reaction in Sterling was reserved, as there was an absence of meaty new statements.

On the flip side, the US dollar has risen over the past week, helped by strong data and bullish comments from Fed Chairman Powell. Today’s focus will be on US payrolls and earnings figures. Both the ADP and ISM reports point to a potentially strong outturn.

OTC outlook:

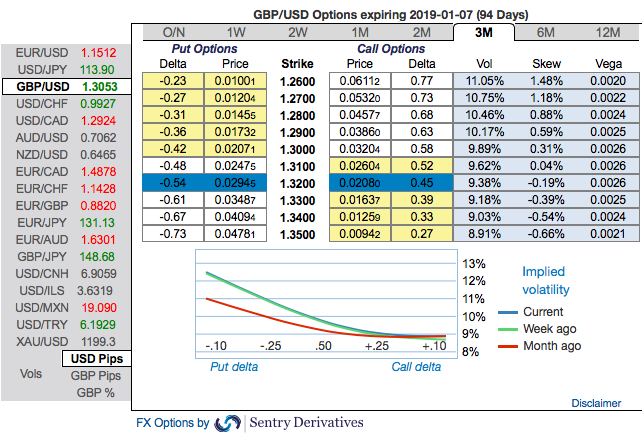

Positively skewed implied volatilities still signal bearish hedging sentiments. To substantiate this downside risk sentiment, risk reversals have also been bearish neutral, no change is observed.

We reckon that the sterling should not suffer like before, but, one should not disregard Fed’s hiking cycle on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

Both the speculators and hedgers of GBPUSD are advised to capitalize on the prevailing price rallies for bearish risks and bidding theta shorts in short run (1m IVs) and 3m risks reversals to optimally utilize delta longs.

On hedging grounds, fresh delta longs for long-term hedging comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, initiate longs in 3m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by delta longs.

The political and economic backdrop remains supportive of sterling’s underperformance. We continue to be short but take partial profits by unwinding the GBPUSD expression of the trade since this is currently in the money but has only less than a week to expiry and is close to the strike.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 98 levels (which is bullish), and hourly USD spot index has bearish index is creeping at 22 (mildly bullish) while articulating (at 11:49 GMT). For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays