The Bank of Japan left its key short-term interest rate unchanged at -0.1% at its March 2018 meeting, as widely expected to be on hold. While the bank will be encouraged by 2017’s growth result, core inflation is still below target at 0.9%. Policymakers also kept its 10-year government bond yield target around zero percent and maintained its upbeat economic view ahead of a new term for Governor Haruhiko Kuroda.

JPY somewhat underperformed in G10 and especially with USD amid firm risk sentiments until early February, and then turned to outperformer, triggered by a plunge in global stocks. On net, as the latter was more dominant, JPY became the outperformer within the G10 camp during the relevant period.

On the flip side, NZD was the worst performing G10 currency vs USD in 2017(refer above chart). A combination of weaker-than-expected economic growth, tighter funding conditions, slowing net immigration and a change of government all conspired to relegate NZD to wooden spoon territory last year.

We don’t think many of these factors will be too different in 2018, and so still see scope for underperformance from NZD in the year ahead.

We foresee that NZDJPY to breach recent ranges to the downside in 1H’18 and forecast the currency at JPY 75.153 by mid-2018. From there, it is reckoned that the currency should settle at USD 72.427 levels by the year-end.

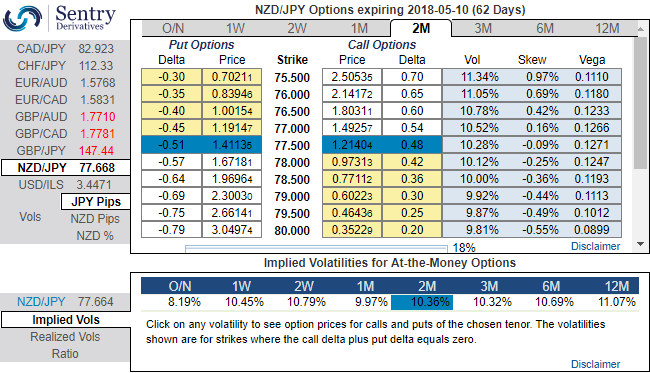

ATM IVs of NZDJPY is trending above 10.30% for 2m tenors and positively skewed IVs of these tenors are evidencing bearish hedging interests. Bids for OTM puts upto 75.50 is noticeable to signify the downside risks which is almost in line with our above-stated projections.

Accordingly, conservative hedgers can prefer the below strategy:

Debit Put Spread = Go long 2M ATM -0.49 delta Put + Short 2m (1%) OTM Put with lower Strike Price with net delta should be at -0.16. Please be noted that the positive payoff structure would be generated as it keeps dipping below current levels but remain within OT strikes.

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

A more muted dollar environment should also tilt USD-correlations lower. Express a soft bearish USD correlation via option triangles that sell USDJPY and NZDUSD puts hedged with long NZDJPY puts.

Currency Strength Index: FxWirePro's hourly NZD spot index is displaying shy above 46 levels (bullish), while hourly JPY spot index was at -52 (bearish) while articulating (at 11:02 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate