The US Federal Reserve maintained monetary policy unchanged last night, as broadly anticipated. The accompanying statement was a little more upbeat than before, noting the improvement in consumer and business sentiment. Importantly, though, there was no strong signal of a near-term hike. Domestically, the House of Commons voted to provide the government the ability to trigger Article 50 to start EU withdrawal negotiations by the end of March.

The Bank of England unanimously announces no change in policy today, leaving rates at 0.25% and the planned total stock of asset purchases at £445bn, and maintain the ‘neutral’ bias adopted in the November Inflation Report.

Notably, Governor Carney’s speech on 16 January repeated that monetary policy can respond “in either direction”, with the MPC for the moment choosing to tolerate a period of rising inflation. The data continue to bear out the UK economy’s post-referendum resilience, while further rises in inflation are coming down the tracks.

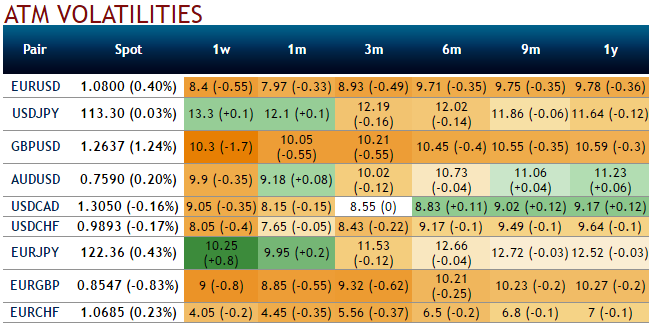

The UK would pursue a different future outside Europe, but the removal of uncertainty around the British stance should prove bearish for GBP volatility. Please be noted that the IVs of GBP crosses (especially EURGBP) has been reducing despite series data, such as the UK PMIs, BoE monetary policy. Accordingly, we’ve devised below option strategy.

Option-trade recommendations: (Writing a strangle)

For those whose foresee non-directional that is existed in this pair from the last couple of months or so to prolong in reducing IV scenario, prefer to remain in the safe zone, we recommend shorting a straddle considering IV shrinks.

Thereby, one can benefit from certain returns by shorting both calls and puts.

Thus, short 7D (0.5% OTM striking) put and (0.5% OTM striking) call simultaneously of the same expiry (preferably, short term for maturity is desired).

The strategy is likely to derive the maximum returns as long as the underlying EURGBP spot FX price on expiry keeps trading between 0.85 and 0.86 levels only as both the instruments have to wipe off worthless. So that the options trader gets to keep the entire initial credit taken as profit.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts