We would like to activate USDCAD longs via options structure to position for USMCA ratification and monetary policy risks. The CAD is soft, down modestly against the USD while underperforming most of the G10 currencies as market participants focus on escalating diplomatic tensions between Canada and China.

The Loonie’s standard driving forces — crude oil prices (WTI) and yield spreads are once again dominating following a period of uncorrelated movement through most of November. A reminder that the CAD also remains completely uncorrelated to the price of Western Canada Select. Headwinds are strengthening as the price of WTI softens back toward the psychologically important $50/bbl level and yield spreads hover just below their recent highs.

The outlook for relative central bank policy is deteriorating as Fed tightening expectations recover, while those for the Bank of Canada is scheduled for their monetary policy this week (on May 6th), that is expected to hold steady, with OIS only pricing about 20bpts of BoC tightening by May. CAD seasonals remain bearish, given the currency’s tendency to weaken into year end and base around the end of January.

The BoC will continue with its hiking cycle over the next two years, whereas the Fed will end its own cycle next year. Hence, we expect the CAD to depreciate.

OTC indications and options strategies:

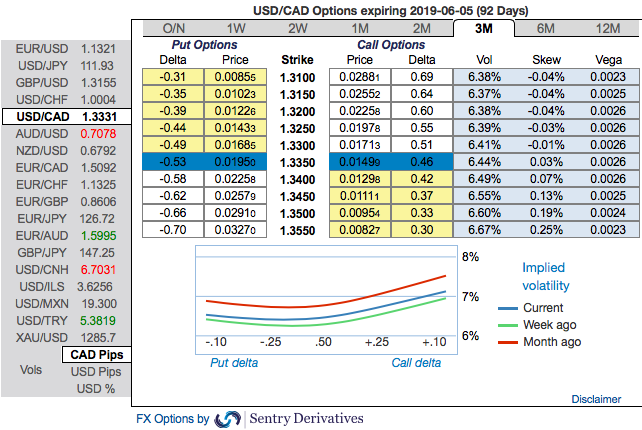

USCAD at spot reference: 1.3337, ATM IVs of 3M tenors are trading a shy above 6.38% - 6.67%, skews are also suggesting the odds on OTM call strikes up to 1.3550 levels at this juncture. Whereas 1m skews are stretched on either side that means hedgers are expecting both downside and upside risks.

We could also notice bullish neutral risk reversals that signal upside risks in the risk-neutral distribution of returns. Also, the IV curve is at, or slightly decreasing, with maturity.

Favor optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

Thus, call spreads are preferred option structures given elevated skew and favorable cost reduction.

We execute USDCAD 3m/1m call spread with strikes of 1.33/1.36 for a net debit.

Maintain the net delta of the position above 40% and shorting the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25%.

Maximum gain is achievable when underlying spot FX move above OTM strike with ideal risk-reward.

By shorting the out-of-the-money call, the options trader finances the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. Source: Sentrix & Saxobank

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at -144 levels (which is bearish), hourly USD spot index was at 75 (bullish) while articulating at (08:22 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?