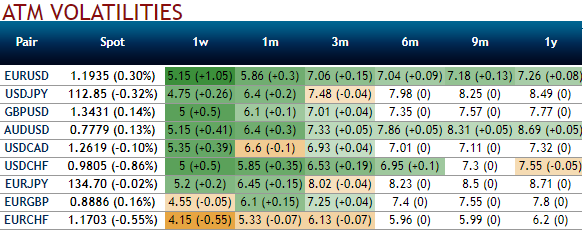

This has been a difficult year for long FX volatility investors and conversely a great one for sellers of volatility but at the expense of growing drawdown risks. Just take a glance trough above nutshell for ATM IVs of G10 FX space that is collapsed below 8% with some exceptions.

The expensiveness and cheapness of volatility have been debated without reaching a consensus, and calls for a switch in the volatility trend have grown louder.

However, we feel that investors – especially those that are not mandated to have long positions on volatility – may be missing the forest for the trees. There is enough uncertainty in equity markets, fuelled by the US heading into the late stage of its business cycle at a time when options prices are at generational lows. With assets and sector correlation so depressed, the bar for turning a profit on options strategies is incredibly low. We, therefore, recommend zooming out of the volatility debate and focusing on individual opportunities to put on hedges for both upside and downside.

Despite the power packed year of central bank events and data releases, 2017 the trading year is going out rather quietly into the night as far as FX vol markets are concerned. Fireworks of last December are conspicuous by their absence this time around, with any chance of a last hurrah for the dollar in a rather forgettable year dashed by no changes to the FOMC’s plan of three unhurried hikes amid strong, non-inflationary growth in 2018.

VXY has once again collapsed to the lows of the year with Fed risks out of the way and the holiday season in sight and delta-hedged returns over the past 2-weeks across various G10 FX blocs have been in the red with the exceptions of CAD-(oil related whipsaw) and SEK-(post-CPI beat gyrations) crosses (refer above chart).

Selectively long FX volatility

A systematic short vol strategy delivered impressive returns this year. But value exhaustion is the main threat to a continued bear trend in vol: the VXY FX vol index is

1) In the bottom decile of the past 25 years,

2) 4-pts lower than at the start of 2017, and

3) 1.5-ppts cheap compared to traditional macro drivers. Set against this, the fundamental case for owning GBP volatility is straightforward and coloured by uncertainty on multiple fronts – around the Brexit process, increasingly dysfunctional domestic politics, continued debate around the abrupt change in the BoE’s reaction function and the risk of an unwind of the 100bp of rate hikes priced along the yield curve should growth and/or politics intercede.

Yet current levels of implied vols are below pre-referendum levels from last year and below realized vol from the trading range of the past 3-6 months.

Depressed volatility is keeping entry costs low while uncertainty increases the probability of a positive return. Japan and core Eurozone are our preferred markets. But the high-speed sector rotation is making the choice and the timing crucial. Ultimately, we also recommend hedging US equities, both upside and downside, as cross-asset correlations (dollar and US rates) can further reduce the option premium and significantly increase the risk/reward.

Long a 1Y vol swap in EURGBP. Opened at 8.85%November 21. Marked at 8.15%.

We've already stated in our previous posts that CAD-cross vols are low and performing. CAD-based implied correlations are priced well below realizeds; owning CADUSD vs CADJPY corr itself or its vol spread proxy in the form of CADJPY – USDJPY vol spreads is a positive carry NAFTA hedge. Courtesy: SG, JPM

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand