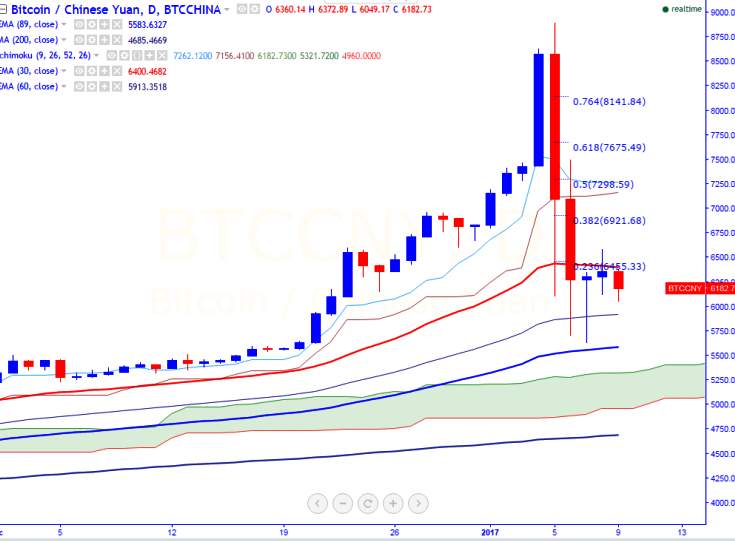

BTC/CNY is seen trading slightly below on Monday. The pair has fallen drastically after showing a slight jump till 6587 levels (BTCCCHINA). It is currently trading around 6303 at the time of writing.

Ichimoku analysis of daily chart shows:

Tenkan-Sen level: 7498

Kijun-Sen level: 7106

Major reversal level -5570 (89- day EMA)

Long-term trend remains to be bullish. BTC/CNY faces major resistance at 6600 (support turned into resistance) and any break above confirms slight bullishness.

Major resistance -6600 (support turned into resistance) and any break above that level will take the pair to next level till 6921 (38.2% retracement of 8896 and 5700)/7500. Short term support is seen at 5517 (89- day EMA) and any break below targets 5316 (cloud top)/4960 (cloud bottom).

FxWirePro: BTC/CNY faces strong resistance at 6600, good to sell on rallies

Monday, January 9, 2017 11:26 AM UTC

Editor's Picks

- Market Data

Most Popular

ETHUSD Breaks $3000 — Bulls Charge Toward $3500+ After BTC Lead

ETHUSD Breaks $3000 — Bulls Charge Toward $3500+ After BTC Lead  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  SEC Drops Gemini Enforcement Case After Full Repayment to Earn Investors

SEC Drops Gemini Enforcement Case After Full Repayment to Earn Investors  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary