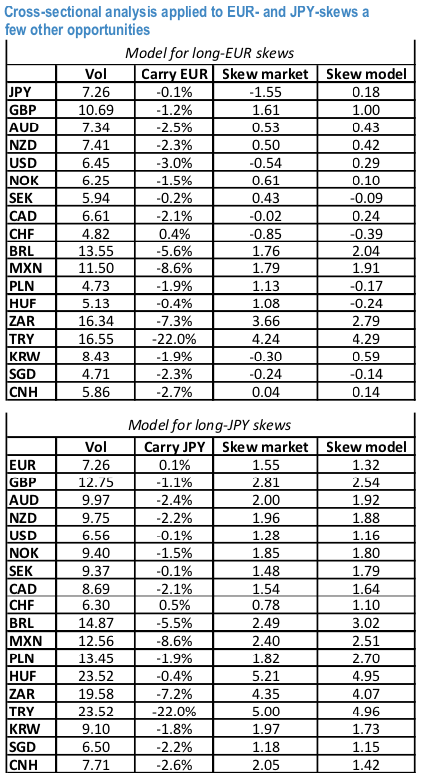

The above nutshell exhibits R2 of the 2-d regression analysis on the EUR has associated a lower R2 (75%) than for USD and JPY (above 85%). The analysis for EUR-crosses confirms the earlier result that EUR calls offer excellent value for hedging a drop of the USD.

We iterate the summarized inference as to how the earlier results could be used in practice. For trading purposes, one would naturally look to enter skew trades which offer

a) a positive dislocation potential, and

b) a natural risk-off exposure. Having incorporated the carry component embedded in risk-reversals, the dislocation analysis should permit highlighting pairs where delta-hedged skew constructs are attractive from a Carry standpoint.

Adding the further constraint of risk-off sensitivity allows selecting long-convexity trades where the cost of Carry is not punitive. The long EUR-skew vs CNH (see again EM vol has peaked for now) would naturally fall within this category: here the 2.7% per year carry would call a higher level of implied skew than what is currently priced by the market.

A few other opportunities that stand out from this perspective could be the cheap AUD and NZD riskies against the USD or the cheap SEK risk-reversal against the JPY.

Based on this measure, when taking into account the contribution of carry and volatility TRY risk-reversals generally screen as fairly valued.

For hedging purposes, the potential of applying these relative-value analyses obviously depends on the specific FX-sensitivities a given institution is exposed to. If we consider international institutions invested in the US market, it would be appealing to find carry-friendly constructs for replacing the costly forward hedges.

At present, the RV analyses above support buying EUR calls / USD puts as a hedge of the long USD positions held by European asset managers, especially given that, unlike most other currencies, the richer side of the skew (USD calls) is also the one where one gets a positive Carry in the cash market.

Aussie dollar is losing its buying momentum as RBA is scheduled for its monetary policy, we expect the cash rate announcement to be on hold. However, our view of two RBA rate cuts in H2 obviously hurts the Aussie but data isn’t likely to stoke much more pricing of rate cut risk before August.

EURAUD on hedging grounds, shorting futures of mid-month tenors are advocated with a view of arresting further potential slumps. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Let’s also quickly glance through the positively skewed 3m IVs of AUDUSD signify the hedgers’ interests to bid OTM put strikes upto 0.6850 level which is in line with above projections (refer above nutshell). While the positive shift in risk reversals of short-term tenors are in sync with momentary upswings in the underlying spot fx, bearish delta risk reversal across all tenors also substantiate that the hedging activities for the downside risks, refer 3rd (RR) nutshell.

Accordingly, we have advocated delta longs for the long term on hedging grounds, more number of longs comprising of ITM instruments and capitalizing on prevailing rallies and shrinking IVs in 1m tenors, theta shorts in short-term to optimize the strategy. Courtesy: Sentrix, JPM & Saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is at 0 levels (which is absolutely neutral), while AUD is at -38 (mildly bearish), while hourly USD spot index was at 127 (highly bullish) while articulating (at 11:15 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures