Sterling was little changed yesterday despite lack of evidence on progress in Brexit negotiations. It has a very light data calendar for the day with nothing of note in the UK or the Eurozone. That is likely to result in UK politics and in particular Brexit negotiations remaining the key focus for markets. However, as yesterday’s meeting between Brexit Minister Raab and EU Chief Negotiator Barnier did not go ahead, it suggests they are still some way from a breakthrough.

Well, we reprise an investigation of sterling volatilities as carried out in an earlier piece. The value of owing optionality for hedging Brexit risk is confirmed.

We update an analysis on sterling volatility as carried out in an earlier piece, following weeks characterized by Labour/Conservative party conferences and UK/EU verbal tensions on the Brexit negotiations.

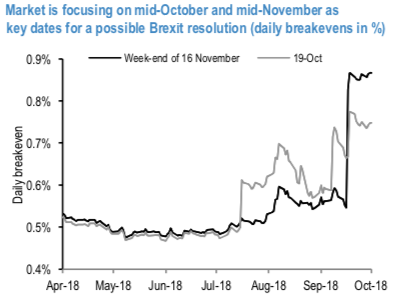

A smooth and upward sloping cable curve indicates the lack of specific risk-events especially in the 3M-1Y segment (where the curve is remarkably flat). If ever, over the past few weeks market attention has increased for the 19 October (EU summit) and mid-November (refer 1stchart), showing the daily breakevens); while an emergency November EU summit hasn’t been announced yet (that would be conditional on substantial progresses in the negotiations to occur in October), markets are closely watching the weekend of 16 November.

While vols have been on the rise since September, they remain very contained compared to the 2016 highs (refer 2ndchart for the 9M maturity): same conclusions are found for the so-called “vol of vol” parameter, which drives the convexity of the smile and the (implied) probability of fat-tail risk events to occur. The widening of risk-reversals in favour of GBP puts / USD calls (by around 1 vol) has been possibly more remarkable. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 102 levels (which is bullish), hourly USD spot index was at 35 (bullish), while articulating (at 14:16 GMT). For more details on the index, please refer below weblink:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data