The RBNZ has cut OCR rates by 50 bps in its monetary policy to keep OCR at 1.00% which was more than the consensus, markets expected only 25bps.

The Kiwis central bank has demonstrated its willingness to take bold steps, which means markets are likely to remain dovishly positioned for some time. As discussed in our recent posts, we now think the odds favor the further RBNZ rate cut the OCR to a new low of 0.75% in November. Combined with easing from other central banks, that should push NZ swap rates to fresh record lows.

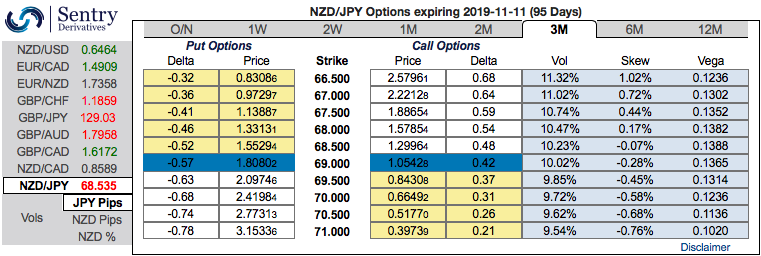

Hence, we reckon that the prevailing rallies of NZDJPY are momentary, NZD is expected to depreciate towards 66 levels by year-end.

Most importantly, 3m IV skews are right indications for NZD that have clearly been indicating bearish risks. Hence, the major downtrend continuation shouldn’t be panicked the broad-based bearish outlook amid minor rallies.

These positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 66.500 levels (refer above nutshells evidencing IV skews).

The global risks are reckoned to play less conducive for NZ than they do for Australia, and the central bank has reason to be credibly dovish even as the data have outperformed some of the downside risk scenarios laid out earlier in 2018. The pair is forecasted to depreciate below 65 levels by year-end.

While the NZDJPY trade is underwater following positive news reports on a US-China agreement. The erratic nature of news flow is one reason why we had suggested NZDJPY shorts via options in the past, suitable options strategy is designed favoring a bearish side. Initiate longs in -0.49 delta put options of 3m tenors, simultaneously, short (1%) out of the money put options of the narrowed expiry (preferably 2w tenors), the strategy is executed at net debit.

Well, a higher (absolute) Delta value is desirable on the long leg in the above-stated strategy. Whereas, the Theta is positive on the short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry). The short side likely to reduce the cost of hedging with time decay advantage on the short leg, while delta longs likely to arrest potential bearish risks. Courtesy: Westpac & Sentrix

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data