In 2016 the Australian dollar (AUD) has benefited from the recovery in commodity prices, but lost grounds at the end of the year to post U.S. Presidential election rally in U.S. Dollar. We expect this to continue even in 2017 following the Federal Reserve’s optimism on three interest rate hikes and President Donald Trump’s fiscal policies.

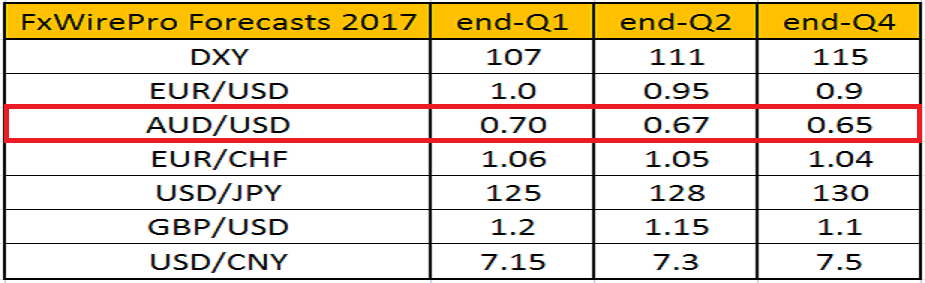

Thereby, we foresee that the AUD/USD to hit lowest since March 2009 by the end of the fourth quarter and trade at around 0.65.

However, the fundamentals supporting Australian dollar are favourable in 2017, keeping economic growth well above 2.5 percent mark. Also, recovery in commodity prices including energy post-OPEC deal will lend further support to the growth trajectory. Interestingly, the Australian economy will remain sensitive to the Chinese grounds as it is the largest export markets for the Aussies, which accounts 32 percent of total exports.

The easier monetary policy has helped to bolster country’s demand, as the Reserve Bank of Australia reacted to sub-target inflation by cutting the official rate by 50 basis points during the last year to 1.50 percent. Additionally, the RBA’s policy stance in 2017 will completely depend on the developments in consumer inflation and in the event that the Australian dollar appreciates.

Moreover, it is worth noting that the heavy sell-off in Australian dollar (AUD) is mainly because of Donald Trump’s fiscal spending appeal, which is expected to be financed from government borrowing and not because of growth in U.S. economy.

If Trump successfully implements his fiscal plan, consumer inflation will surely rise, giving the Federal Reserve wider space for an interest rate hike. Thereby, rising Fed fund rate will increase the cost of borrowing. After the Presidential election result, AUD witnessed a massive selling against U.S. dollar, sending the AUD lower by 8 percent to 0.715 in just a month’s time.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings