The RBA surprised by cutting in May, which suggests another cut to 1.5%, probably in August. The RBNZ is expected to cut to 1.75% in June.

With both central banks behaving similarly near term, we would expect the cross to consolidate around 1.07-1.09 during the weeks ahead. Multi-month, though, there is a case for higher, towards 1.1200, given it is currently well below fair value implied by interest rates, commodity prices and risk sentiment.

On the flip side, although markets have fully priced in a 2.0% OCR, they are aware the risks for the RBNZ are mainly to the downside and see potential for the OCR to fall below 2.0% if global shocks materialize.

On data front, Kiwis trade balance is scheduled to be announced tomorrow, NZ trade surplus increased to NZD 117 million in March of 2016 compared to a NZD 661 million surplus a year earlier and it is likely to reduce to 25M.

OTC Updates:

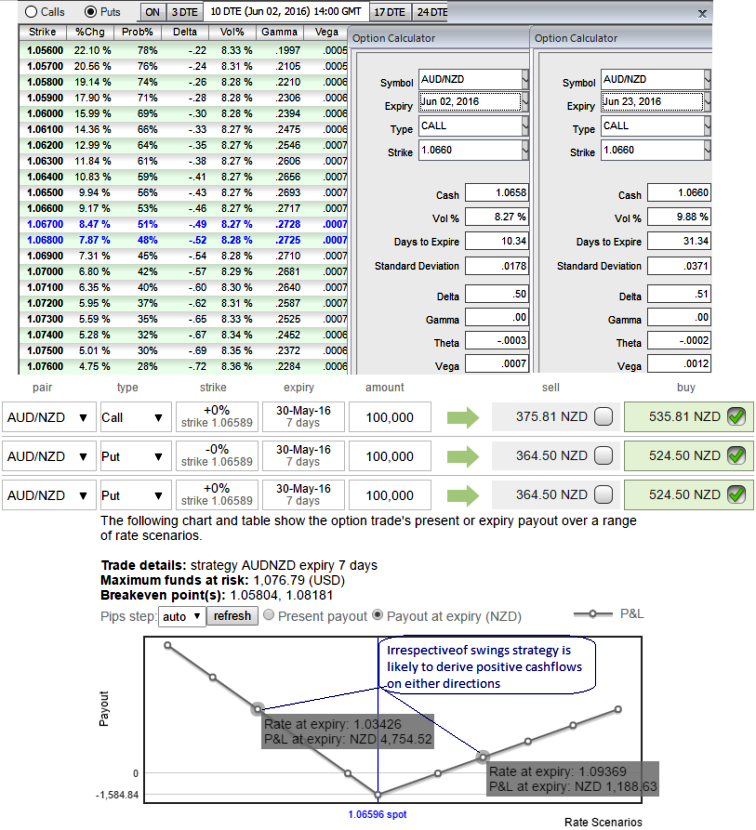

ATM IV of 10 days tenor is at 8.27%, likely to inch higher in 1m tenors and OTM put strikes are flashing with higher probabilistic numbers with juicy gamma on these strikes.

While gamma is drifting healthily when we shift 50 pips either side, slightly conducive to put strikes with higher likelihood of these strikes finishing in the money.

A larger Gamma means the Delta is more sensitive to a change in the underlying market price, which means a larger risk or reward.

Technically, weekly graph has shown 7EMA crosses below 21EMA that is a sell signal and as a result current price has been evidencing mild downswings every now and then.

Currency Option Strategy:

The options strips were deployed anticipating more downside potential in this pair, now have a look at the diagram various spot FX rate and their payoff structure. We've been firm to hold on this strategy on hedging grounds. The potential target on upside is about 50-100 pips where 100-130 pips on downside.

The rationale is that any potential downswings should be optimally utilized, so to participate in that downtrend, weights in the portfolio should be doubled with ATM puts.

So, let’s hold 15D At-The-Money 0.50 delta call and simultaneously hold 2 lot of 1M At-The-Money -0.50 delta put options.

Huge profits achievable with the strip strategy when AUDNZD exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move.

Competitive advantage of this strategy: As shown in the diagram the trader can still make money in either way even if the trade anticipation goes wrong - but the underlying pair has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Please be noted that the expiries shown in the diagram are for demonstration purpose only, use appropriate tenors as stated above.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data