Crude oil markets are growing nervous, days before OPEC is due to meet in Vienna on 30 November. Front-month prices on ICE Brent are currently retracing around $62.37, down $2.23 from the November highs and putting a pause to a four-month rally.

Brent futures, the benchmark for oil prices outside the U.S., shed 35 cents, or around 0.5%, to $62.55 a barrel by 10:32 GMT.

Much of this week’s profit taking is the result of the market sifting through the data and separating the transitory noise from the underlying trend. Meanwhile, growing concern that Russia was reluctant to support an extension of an existing OPEC-led production cut agreement further weighed.

In its latest monthly report, the IEA opined that the post-summer rally was more the result of temporary supply disruptions, citing lower-than-expected production from North America, supply interruptions in Iraq, geopolitical instability in the Middle East as well as “a growing expectation that the OPEC/non-OPEC output accord will be extended through 2018”. This week’s US petroleum report surprised the market with a 1.9m barrel stock built (vs -2.4 consensus). Moreover, questions already abound about Russia’s commitment to a renewed OPEC accord.

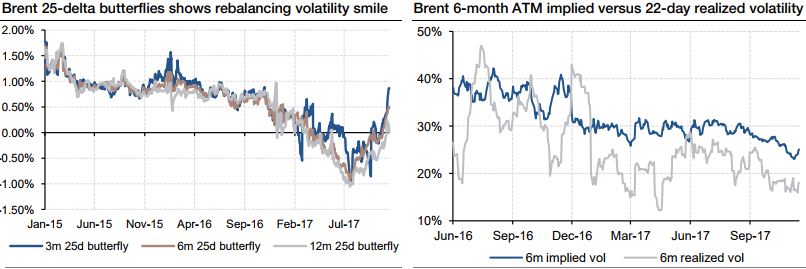

Regardless, sentiment has noticeably turned more constructive on the energy complex in the second half of the year, and in the options market as well. The shape of the volatility smile has seen the impact of relatively higher interest for call options. The bottom-left chart shows contant maturity 25-delta butterflies on short and long-dated Brent options. After bottoming out in July at -1%, these have again turned positive, suggesting the relative volatility premium of OTM put over OTM call options has eased.

25-delta butterfly: 25-delta call IV + 25-delta put IV – 2 x ATM IV.

A negative 25-delta butterfly arises when the volatility smile turns concave between the 25- delta strikes, i.e. when one of the wings is at a significant discount to the ATM.

In July 2017, call options were heavily sold to finance put options in producer collars or three ways. Courtesy: SG

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data