Of-late, the smoldering trade war is and remains the dominant subject for the financial markets, and has caused considerable movement in the CNY and USD exchange rates over the past few weeks.

Yesterday China’s State Council released a few policies, which substantiates that China has turned its focus to growth for now.

The measures include a) Fiscal policy will be more proactive; b) Monetary policy needs to be more supportive; c) Boost the domestic demand significantly; d) Support the reasonable financing demand from SMEs and local governments.

While the dollar strength resumed from last two weeks, leaving the broad dollar sitting at its 14 month high. Market focus over this period has been squarely on China, although conditions in the US have also played a role. Three dynamics have been relevant for FX in the past two weeks.

First dynamic, the prevailing turndown and the shake-up in the interest rates in China which has impacted USDCNH. Initially, the pair was resistant to this widening, however, the escalation in trade anxiety in the recent past and the resulting implications for China exports has caused FX weakening a viable policy response. As a result, the consequential currency depreciation has been sizable - the CNY TWI has weakened by 3.5% in the past month, the largest monthly decline in nine years.

Secondarily, China and the escalation of trade dispute has predominantly been on commodities, arguably this space has taken the brunt of the rising tail risk around China growth (JPM’s economists note that actual data has been in line with our expectations) with base metals and ags experiencing double-digit declines in the past month— even though the impact of this is yet to be totally realized by commodity driven FX.

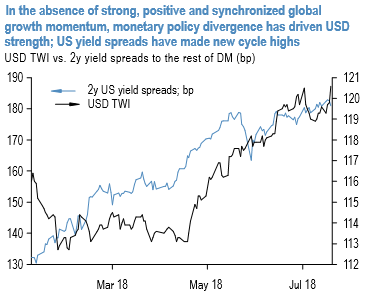

And finally, setting China aside, macro conditions in the US remain firm with our economists now indicating upside risks to their 4%ar 2Q growth forecast. US yields reflect this: 2-year Treasury rates made a new cycle high and US yield spreads to the rest of DM (refer above chart). Indeed, USD strength has coincided with wider yield spreads. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly CNY spot index has shown 147 (which is bullish), while USD is flashing at -37 (bearish), while articulating at 13:40 GMT.

For more details on the index, please refer below weblink:

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch