There are much more interesting central bank decisions on the agenda this week than last’s week ECB non-event. The Fed, BoJ and BoC, in particular, would be interesting. The little bit we heard from FOMC members last week was not exactly enlightening. BoC maintained status quo in recent monetary policies, and left the key interest rates unchanged at 1.75%.

The CAD has made further progress against the major pairs, in fact, despite soft Retail Sales and Wholesale Trade data. The BoC Business Outlook Survey reflected a small uptick in business confidence and resolute optimism on future sales prospects, meanwhile.

On the flip side, the BoJ seems unlikely to be completely idle. Indeed, we might well see some tweaks to the framework similar to the adjustments made in July 2018, which saw the introduction of forward guidance, a halving of the size of the balance of current accounts subject to the negative policy rate, and an amendment of the amounts of each type of ETF to be purchased. At a minimum this time around we expect a revision to the BoJ’s forward guidance, which for some time has stated that it “intends to maintain the current extremely low levels of short- and long-term interest rates, at least through spring 2020”. JPY remains flat amid no major developments on the US-China front but the sentiment deteriorates on the reduced safe-haven demand.

Contemplating monetary policy outlook and geopolitical surface, we refer to JP Morgan’s analytical piece and emphasize on the long vega exposure - 6M6M/+1Y6M FVA 1*2 spreads for hedging the simmering broad-based risk sentiments.

Their reaction function, especially relative to the Fed, will likely remain one of the biggest uncertainties around CAD’s relative performance. CAD 2y OIS has declined 11bps in the past month, and now is pricing in up to three cuts by end-2020, starting in December. Our economists are forecasting the BoC to deliver insurance cuts in Oct and Dec, although uncertainty around this is higher for BoC than perhaps elsewhere where central bank rate cuts are being priced in.

While the US-China trade developments remain very fluid and we are bound to see a few more adverse episodes.

The Cheap vega ownership could be deployed in anticipation of the vega tenors receiving more attention with the spot now under the watchful PBoC hand, we recommend using the favorable vol entry levels to add vega.

Utilizing attractive pricing and positive rolldown, 1x2 FVA spreads are time passage friendly and low maintenance long vega positions that struck us as a solid buy in the current environment where low decay vega is well sought after. The basic construct involves selling shorter dated FVA along upward sloping segment of the vol curve to partially fund the purchase of a longer dated FVA that sits on a flatter part of the term structure. The roll-down of the short leg then compensates (or even eliminates, as is the case for CADJPY) the slide of the long position, all the while preserving the overall structure’s net long vol characteristic. The short leg is not large enough to disrupt the net positive sensitivity of the package to vol upturns. Consequently, the structure is a carry efficient risk off hedge.

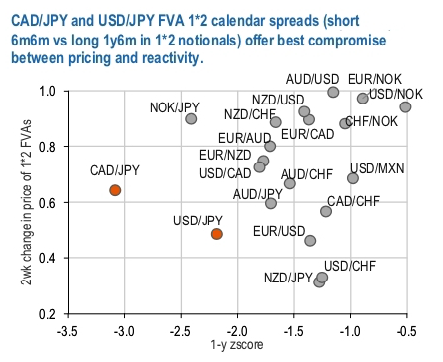

We screen for the FVA spread candidates based on their pricing (in form of a 1y z-score) and the sensitivity to the ongoing market turbulence (in form of 2-week change in pricing of the package) (refer above chart).

In case of CADJPY the current levels are still a bargain by historical standards, even after the recent bounce. The net 6-month static vol slide (at expiry of the short leg) deteriorated as the front vols spiked on the back of the recent spot gyrations but is still positive thus making the long/short structure superior to holding a similar long dated straddle.

Consider: short 6M6M CAD/JPY @8.7ch vs long 1Y6M @8.55/9.05, in 1:2 vega weights or short 6M6M USDJPY @7.6ch vs 1Y6M @7.55/7.95 indic, in 1:2 vega weights. Courtesy: JPM

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms