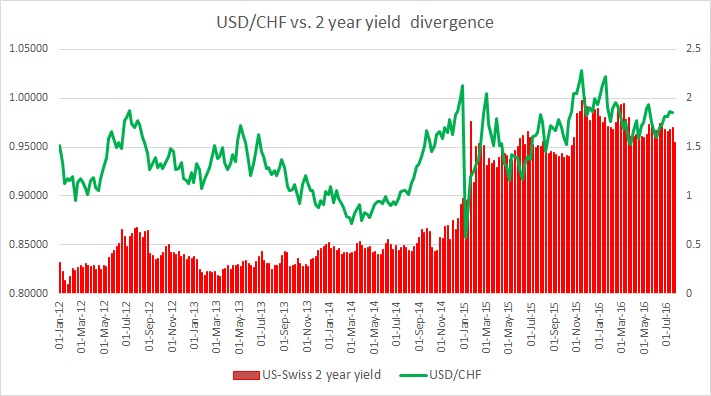

In recent days, Swiss franc’s correlation with the 2-year yield spread (US-Swiss 2 year) has dropped to 25 percent but time on time again it shows relatively high positive correlation, as high as 80 percent at times. Just before and after the Brexit referendum in the UK, the 20-day rolling correlation was averaging above 60. Hence, it is vital to keep a watch on the Swiss yields.

Just after the Swiss floor shock in January 2015 when the Swiss National Bank (SNB) removed a floor in EUR/CHF at 1.20 this relation went to negative and stayed there until October with occasional bounces to positive territory. It hasn’t gone to the negative since and was closely related to the yield (above 80 percent) in January this year.

Unlike the euro or the pound, the Swiss franc is considered a safe haven, hence the yield relation sometimes gets overlooked.

However, Swiss yields are a must watch as they are the lowest for any government bonds in the world and any shift in that will mark a major turnaround in trend. The above chart explains how the relation between the spread and exchange rate has unfolded since 2012.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains