The event the world has been awaiting, preparing and speculating for is finally approaching - meeting by US Federal Reserve, in which US interest rates will finally rise from their zero bound. After Friday's super job report market is now pricing 81% probability that FED will hike rates in its December meeting, scheduled for December 15th-16th.

In this, FED liftoff series, we will be discussing over the impact, implications and various possibilities of a first rate hike from FED after more than 9 years. Last time FED hiked rates was back in 2006.

In previous articles we discussed why rate hike from FED is still crucial, despite it being well priced in and beginning of a mega unwinding of monetary stimulus.

In this piece, we address term premium.

Term Premium

Term premium is the compensation that investors require for bearing the risks that short term treasury yields do not evolve as expected. While Term premia can be a comlex concept (if interested visit former FED chair Ben Bernanke's blog - http://www.brookings.edu/blogs/ben-bernanke), and might fall beyond the scope of regular traders and investors, we would like to issue this term premium on more simpler ground - the amount at which the yield to maturity (ytm) for a longer term treasury exceeds that of a short term bond.

Lessons from history

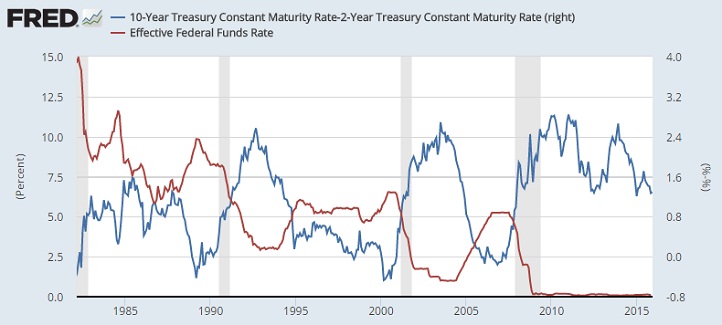

If history is of any guide, then going by that term premium could actually fall with rise in effective federal funds rate.

Back in 1989, when FED cut back interest rates from 9.75% to 3% by 1993, term premium (10 year -2 year) actually went up from negative to close to 2.6%, whereas when it increased rates in 1994 from 3% to finally 6% by 1995, term premium was in close proximity to zero. When the cycle finally ended in 2000 with rates at 6.5%, premium was back in negative.

In the next cycle FED reduced rates from 6.5% to just 1% in January 2014, premium got back to 2.7%, which dropped again to negative by end of hike cycle in 2006.

Since, same phenomenon occurred in 2008-2013, while FED reduced rates, it would not be very unfair of similar past phenomenon while it hikes.

It is just as Mr. Bernanke pointed out in his blog, that FED has control only over short term rates and its influence over long rates is minimal. Instead he refers to Wicksellian rate as driver of long rates, which depend on inflation, government borrowing, tax policy, state of the economy and many more.

At this point you might wondering, what the hell.........

the FxWirePro guys, suddenly turned economist or what?.........we believe this talks will get into regular financial market concept as current FED chair Janet Yellen regularly talking about bringing interest rates to close to level neither expansionary nor contractionary. So its best to stay ahead.

Aberration

However, there are some reasons to be believe that this time could be different. Never before FED was sitting on a balance sheet of $4 trillion and rates has never been to close to zero for so long. This phenomenon might have boosted some sizable risk taking both for financial and non-financial. This is quite evident from the size of carry trades and size of non-financial corporations' debt size, especially in emerging markets.

Markets might have gone ahead of them, in search for yields in a time of abundant money. So this time there is a risk that even if term premium drops it could be less steep or to say long rates could go for a rise.

Mr. Bernanke puts it well - ".......In addition, banks and other market participants may have taken on more interest rate risk than they will be easily able to cope with as rates rise. The rate risk can come from several sources. The prolonged upward slope of the yield curve and assurance that short-term rates will remain low for long could have induced some to take on carry trades that will lose money as short-term rates rise and long-term rates also move higher. Central bank purchases of longer-term assets, including gilts, have driven down term premia embedded in yield curves, suggesting the adjustment at the long end of the curve could be especially sharp, combining rising rate expectations and higher term premia. A sudden surge in longer-term rates -snap-back risk - could cause bond investors to pull back, exacerbating the rise in long-term interest rates."

It is just like we said in this series' first post, despite all expectations priced in, a hike from FED is no ordinary phenomenon even then.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says