The event the world has been awaiting, preparing and speculating for is finally approaching - meeting by US Federal Reserve, in which US interest rates will finally rise from their zero bound. Market is now pricing 72% probability of a rate hike by FED this week. Meeting scheduled for December 15th-16th.

In this, FED liftoff series, we will be discussing over the impact, implications and various possibilities of a first rate hike from FED in about a decade. Last time FED hiked rates was back in 2006.

In previous articles we discussed why rate hike from FED is still crucial, despite it being well priced in, beginning of a mega unwinding of monetary stimulus, our take on US rates via term premia and impact on equities.

In this piece, we take up from where in equities article, we concluded that path of US rate hike more important than the first rate hike and discuss the probable rate hike path.

Market pricing of rate hike path -

Market is pricing more gradual approach from FED after first hike, probably on Wednesday.

- March, 2016 meeting - Market is attaching 14% probability that rates will remain 0 - 0.25% , 49% probability that rates will move to 0.25-0.5%, 33% probability that rates will be at 0.5-0.75% and 5% probability that rates will be at 0.75-1%

- June, 2016 meeting - Market is attaching 9% probability that rates will remain 0 - 0.25% , 34% probability that rates will move to 0.25-0.5%, 38% probability that rates will be at 0.5-0.75%, 16% probability that rates will be at 0.75-1% and 3% probability that rates will be at 1-1.25%.

So, not until June meeting, market is pricing with more than 50% probability (57%), that rates will be higher than 0.5%.

Economists' expectations -

A poll of economists conducted by Financial Times, show economist are well divided in their expectations for rate hike path.

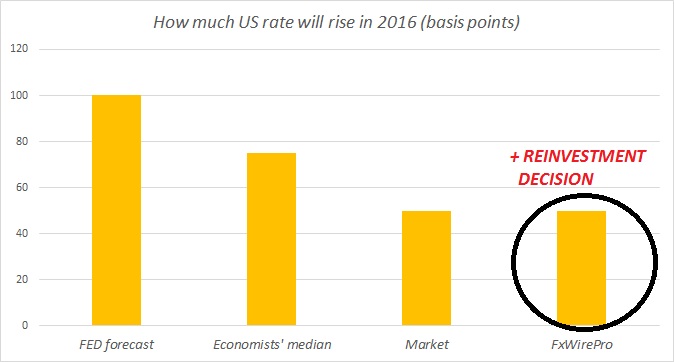

24% of the economists expect two rate hikes in 2016, 25 basis points each, 39% expects three rise and 30% expects four rise, rest 7% divided over one and five. Median projection says, FED will hike rates by 75 basis points in 2016 and 100 basis points in 2017.

FED projection -

According to latest projections available (September......latest will be released in December), one policymaker (probably Evans) expect rate to stay at zero bound, two at 1%, four at 1.25%, two at 1.5%, three at 1.75%, one at 2%, two at 2.25%, one at 2.5%, one at 3% (probably Lacker).

Median projection says, FED to hike rates four times in 2016 of total 100 basis points.

FxWirePro's take -

We are yet to finalize our forecast for 2016 that we will do after Wednesday's FOMC, in which we expect a hike by 25 basis points.

So far, to this point, we expect FED to be gradualist in response to rate hike. According to our view, path of the hike would depend on FOMC's decision on reinvestment. FED is sitting on a balance sheet of $4 trillion and in 2016, we expect FED to address that, most probably in December meeting or after that (before another hike). At this point, we expect one or two hike from FED, depending on the reinvestment decision and that not before June.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook