D-day is finally here, last FOMC meeting of the year, decision today, in which FED is widely expected to increase rates from zero bound by a hike of 25 basis points, almost a decade after last one. The decision would be announced at 19:00 GMT, followed by a press conference at 19:30 GMT by FED Chair Janet Yellen.

Market is pricing 83% probability that rates will rise in today's meeting as of now.

In this, FED liftoff series, we have been discussing over the impact, implications and various possibilities of a first rate hike from FED in about a decade. Last time FED hiked rates was back in 2006.

In previous articles we discussed why rate hike from FED is still crucial, despite it being well priced in, beginning of a mega unwinding of monetary stimulus, our take on US rates via term premia, impact on equities, various expectations over FED hike path and first part on our take on Dollar (mainly D-Dollar).

In this piece, we take on the C -Dollar.

C- Dollar -

Previously we discussed, in today's modern financial world, there exists no single US Dollar, but at least three US Dollar, each of which can experience different impact. We are calling them

- Dollar against developed market currencies (D-Dollar)

- Dollar against commodity currencies (C-Dollar)

- Dollar against emerging market currencies (E-Dollar)

One might say, ok why not say Dollar would have different impact on developed market currencies, commodity currencies and emerging market currencies. While it is definitely could be one way to put it, however any such saying would be half sided.

Saying since emerging markets are weak, Dollar would get strong against them would be seeing just one side of the coin.

Federal Reserve's ultra-loose monetary policies for seven years, essentially led to the development of these very distinguishing three Dollars, especially the last two, by influencing the flow money. Now with FED looking to reverse course in its monetary policy so are the flows.

Moreover, this C-Dollar would have its impact beyond the usual commodity currencies and to equities and bonds for the matter......hence the differentiation.

Rise of C-Dollar and China -

While China gets majority share of the blame for drop in commodity prices, it is actually the rise of the C-Dollar that contributed to the drop in commodities' prices today.

In the wake of ultra-loose monetary policies from US Federal Reserve, there was a real hunt for yield. Investors and banks can't be blamed entirely as it was FED's intention to inflate the asset prices to improve income. However, risk taking was more elevated that FED originally assumed.

Banks and investors jumped to gobble up the commodity contango spread. Post FED actions to push rates to zero bound and asset purchase, there was rush to build storage for commodities. Lot of projects, which wouldn't be viable at lower price got financed both domestic (shale oil) and overseas (metals). Commodities were used to gobble up spread between China and US rates since Renminbi was expected to be capped on the upside was clearly on a rising path.....one such example could be copper financing deal. By 2013, there were tons of copper, Aluminium, Nickel, barrels of shale oil in storages across globe, much more than actually required.

Slowdown in China, coupled with reversal in course of C-Dollar (banks, investors were jumping out of that trade by end 2013) led to today's commodity glut.

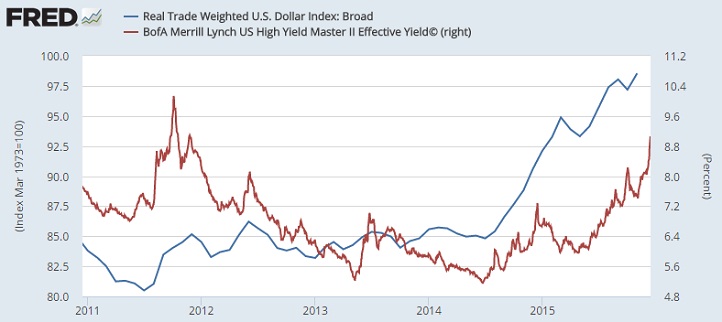

Since this C-Dollar is stuck into those commodities and projects, it's trying but can't return as course of flow reversed, leading to what we are seeing rise in domestic bond yields (junk and energy) and drop in commodity exporters' currencies.

Of course policy easing by commodity exporters, such as Australia, New Zealand do contributed.

Going forward -

First hike may be symbolic, but we expect, devastation by C-Dollar, in commodity corporations bond and equity market to continue, even if currencies recover and subsequent hikes only exacerbate the trend. Expect lots of defaults in this segment.

Moreover, strong Dollar would have profound impact on oil exporting countries and their fiscal position. Saudi peg to Dollar, likely to come under further stress.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty