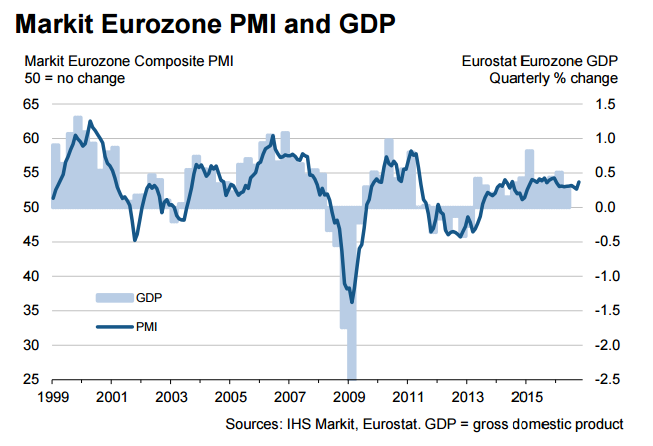

Eurozone flash PMI data released earlier today showed that suggested that the region's economic recovery strengthened over the course of October. IHS Markit's purchasing managers’ index (PMI) used by the European Central Bank (ECB) to assess the health of the region’s economy, rose to 53.7 in October, up from 52.6 in September, well above consensus expectations for a reading of 52.8 and the highest seen so far this year.

Details of the report highlighted divergence between the region's two largest economies. German growth gained significant momentum to show the second-largest monthly increase so far this year. By contrast, the pace of growth slowed in France. Elsewhere, output growth across the rest of the region revived from September’s 21-month low but remained one of the weakest expansions recorded over the past two years.

"The Eurozone economy showed renewed signs of life at the start of the fourth quarter, enjoying its strongest expansion so far this year with the promise of more to come. With backlogs of work accumulating at the fastest rate for over five years, business activity growth and hiring look set to accelerate further as we head towards the end of the year," said IHS Markit chief business economist Chris Williamson.

The Eurozone economy is likely to continue to strengthen in coming months as indicated by faster growth of orders books and acceleration in the pace of hiring. Details of the report showed new order growth was the highest since January, prompting firms to take on extra staff. Employment showed the biggest gain for three months. Average prices charged for goods and services rose for the first time since August 2015 on firming demand.

“October’s PMI is consistent with a quarterly GDP growth rate of 0.4%, adds Chris Williamson.

October also saw the extent of manufacturing supply chain delays hit one of the highest in five years. Supply shortfalls usually lead to a rise in prices. Signs of both stronger economic growth and rising price pressures and the expectations of a robust Q4 could fuel speculation of QE tapering by the ECB.

EUR/USD was trading at 1.08920 at around 12:00 GMT. The major has shown continuous downside for the past ten trading sessions. On the lower side, major support is around 1.08475 (161.8% retracement of 1.1045 and 1.13660) and any break below targets 1.0820 (Mar 10th 2016 low)/1.0775. The pair immediate resistance is around 1.0902 (23.6% retracement of 1.10392 and 1.08953) and any break above will take the pair to next level till 1.09500/1.09715.

US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes

US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Paul Atkins Emphasizes Global Regulatory Cooperation at Fintech Conference

Paul Atkins Emphasizes Global Regulatory Cooperation at Fintech Conference  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist  U.S. Stock Futures Edge Lower as Tech and AI Stocks Drag Wall Street Ahead of Key Earnings

U.S. Stock Futures Edge Lower as Tech and AI Stocks Drag Wall Street Ahead of Key Earnings  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China Services PMI Hits Three-Month High as New Orders and Hiring Improve

China Services PMI Hits Three-Month High as New Orders and Hiring Improve