September economic data from the Eurozone showed resilience, in line with rhetoric from ECB president Mario Draghi suggesting that the Euro-Zone is showing signs of a modest recovery. Economists expect Eurozone growth could surprise on the upside in H2 2016. However, uncertainty surrounding the economic projections still remain high as the Brexit withdrawal negotiations, which are set to begin next year, may affect economic sentiment.

The Euro area manufacturing PMI figure for September rebounded towards pre-Brexit vote level and order-inventory balance, a leading indicator for manufacturing PMI, increased to the highest level since 2010 indicating that going forward the manufacturing PMI will increase considerably. Service PMI continued the downward trend but kept above 50 signalling healthy GDP growth.

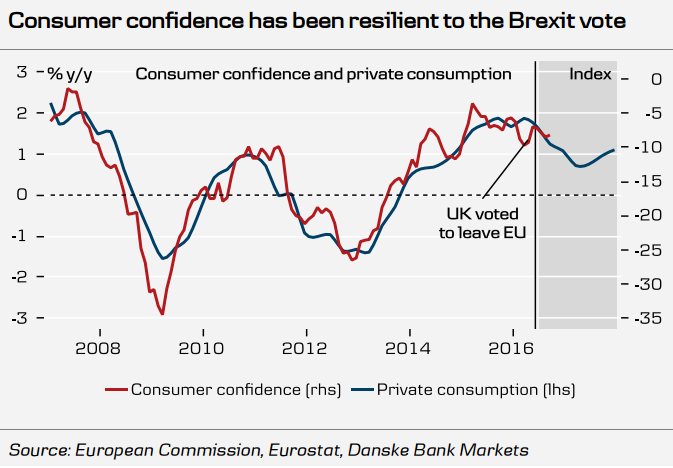

Consumer confidence for September also revealed a modest increase which points to continued solid growth in private consumption. Data released earlier today showed that economic sentiment index in September bounced back in both the euro area and the European Union after three months of negative or flat developments. Sentiment in the services sector, which generates two-thirds of the euro zone's GDP, rose to 10.0 in September. The European Commission noted that sentiment improved the most in the biggest eurozone economies - Germany, France, Italy, Spain and the Netherlands.

"Our forecast for GDP growth is 1.5% in 2016 and 1.1% in 2017 with the latter mainly reflecting an expected weak start to the year. We see some downside risk to our 2017 forecast as the political events including the Italian constitutional referendum later this year, and the parliamentary and presidential elections in Germany, France and the Netherlands in 2017 could have a negative impact on the euro area economy." Danske Bank notes in a report to clients.

Economic sentiment is an early indicator of economic activity, signalling trends in gross domestic product growth. Survey found that households expected prices to rise more rapidly over the coming 12 months than they did in August, while businesses also expect to raise their prices more rapidly suggesting a positive boost to inflation as well. The improved economic situation in the euro area supports the ECB’s slightly hawkish stance expressed at the latest meeting in early September.

EUR/USD is extending upside after bounce off 20-DMA on Wednesday's trade. The major was 0.04 percent higher on the day, trading at 1.1222 at around 12:00 GMT.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility