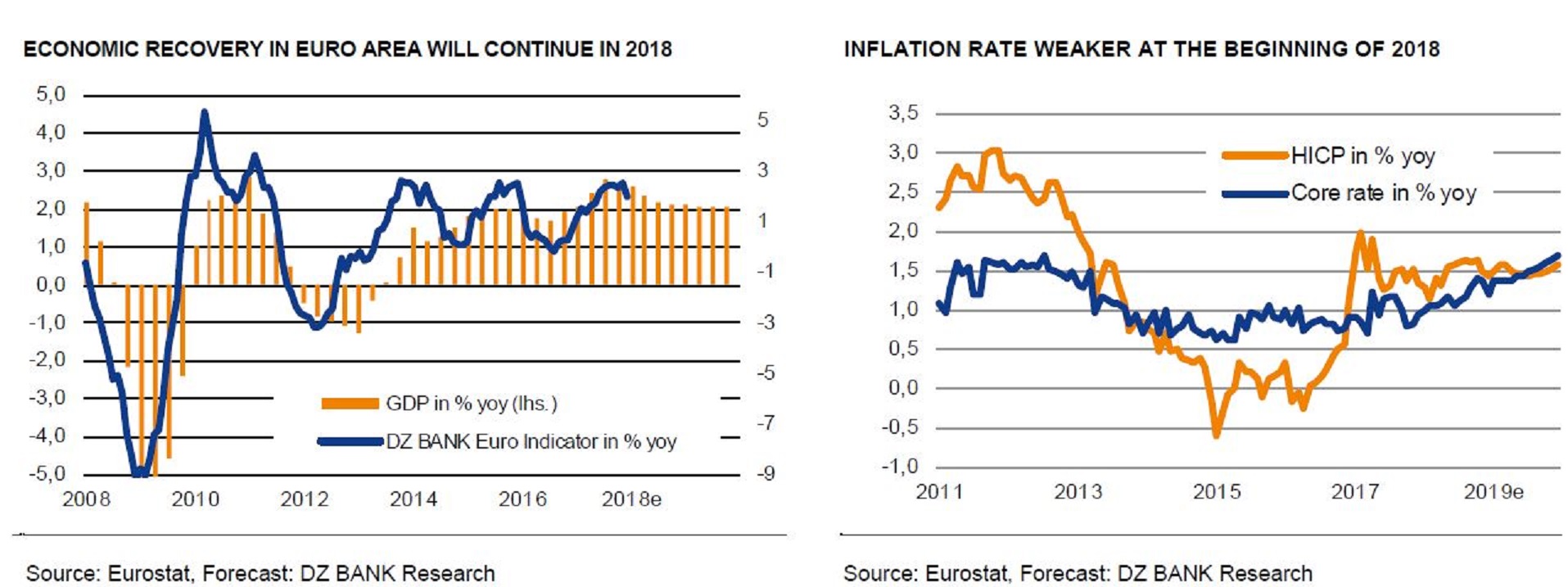

The eurozone economy is not expected to run out of steam in the near-term and is expected to grow by 2.8 percent through this year, according to a recent report from DZ Bank AG. The economy grew by 0.6 percent compared with the previous quarter in Q4 2017, according to a preliminary flash estimate.

As such, although economic growth in Q4 could not quite match the strong pace of the previous quarter when it grew by 0.7 percent, 2017 nevertheless saw a strong performance overall. Overall, GDP growth in the eurozone in the full year 2017 was 2.5 percent against the previous year.

Other leading, survey-based indicators are also at levels which suggest that the strong upturn is set to continue. 2017 should provide a very solid basis for further economic growth. However, it is likely to be difficult to step up the tempo even further, given already relatively strong economic growth last year.

"We generally expect slightly slower growth in the next few quarters, albeit still well into positive figures. We are therefore upgrading our economic forecast for the full year 2018 from 2.0 percent to 2.3 percent. The economy is still likely to grow by as much as 2.0 percent in 2019," the report commented.

At the same time, the forecast for the eurozone as a whole is largely reflected in individual country forecasts. Italy's economy grew by 1.5 percent against the previous year in 2017, its strongest performance in eight years. However, prospects for 2018 remain muted since it is likely to be difficult to form a new government after the election on 4 March. Growth this year is set to be unchanged at 1.5 percent.

The economy in the smaller countries of Finland and Austria is doing very well. Growth last year in both countries was slightly over 3 percent. Whereas Finland is able to benefit more from Russia's economic recovery, Austria's economy is being buoyed by better conditions in Central and Eastern Europe. This momentum is likely to lead to a growth of 2.7 percent respectively this year.

In 2017, Portugal's economy, which was hit especially hard by the financial crisis, at last, started to pick up momentum. In this respect, the country is benefiting from generally good economic conditions, but also from the economic prosperity of its neighbor, Spain, Portugal's most important trading partner. We are raising our growth forecast for 2018 from 2.0 to 2.4 percent.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility