Last week’s report showed that the inflation rate in the Eurozone quickened. The Inflation rate is set to rise to 1.1 percent in December after rising to 0.6 percent in November. Eurozone’s largest economy, Germany saw inflation quicken to 1.7 percent, while some region reported as high as 1.9 percent. This has already sparked a debate whether the European Central bank (ECB) should cut down on its easing commitments or not, which just in December announced an additional purchase of bonds worth €540 billion.

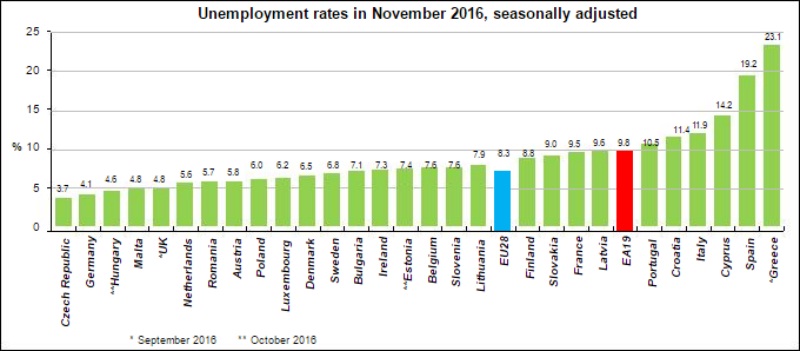

One of the biggest challenges the European Central bank (ECB) faces is the fragmented labor market. Not all labor market across the Eurozone benefited or recovered the same way since the debt crisis of 2011. Today’s unemployment report showed that the unemployment rate at 9.8 percent, 7-year low. But, while German unemployment has declined to post-reunification low of 4.1 percent, the unemployment rate in Greece remained at 23.1 percent. The unemployment rate even in the third and fourth largest economy of the Eurozone; Italy and Spain are as high as 11.9 percent and 19.2 percent.

The biggest risk ECB runs is the deterioration of economic condition in these economies, if it is forced to raise rates amid a quickening of inflation.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022