Euro Zone is facing one of the most diverse economic recovery and labour market. Partial reforms pursued by governments coupled with easy monetary policy from European Central Bank (ECB) has led to the rise in employment across Euro Zone, however any level that can be called as normal remains far off.

As of now inflation is low with thanks to lower oil price, however if inflation do return before fragmentation is removed ECB would face critical policy choices, weather to raise rates to prevent any overheating of stronger economies with lower unemployment rate or to keep easing to bolster growth across the weaker ones like Greece, Spain, Cyprus.

European Central Banks (ECB) and the governments need to coordinate together to pursue reforms in such that economies converge and fragmentation gets reduced.

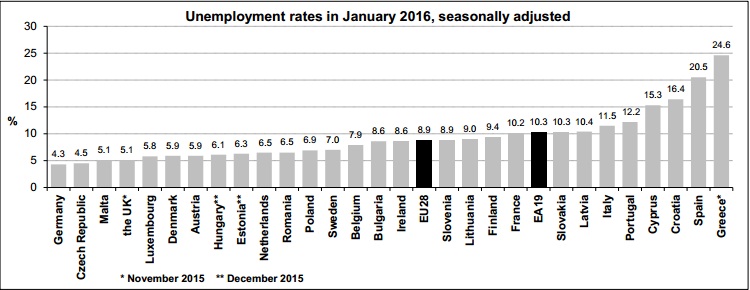

As of latest employment report fragmentation still high, despite improvement in the overall labour market -

- Euro area unemployment rate dropped to 10.3%, which is lowest reading since August 2011. However lot is still to be done as more than 16 million still remains unemployed in Euro area.

- Fragmentation is quite large. While Germany enjoys lowest unemployment rate in the region at 4.3%, Greece and Spain have their rates above 20%.

- Even in France, every one in ten is unemployed.

- Euro area's third largest economy, Italy is suffering unemployment as high as 11.5%.

ECB is likely to take further policy measures on March 10th meeting, which would derail Euro lower. Euro is currently trading at 1.087 against Dollar.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off