Since European Central Bank (ECB) disappointed in December, sentiment started deteriorating in Euro zone. New Year turmoil across global stock market increased the tempo of deterioration.

- European Central Bank (ECB) again gave assurance to act in March further and keep policy very accommodative for very long and that might boost sentiment from March.

- Concern over immediate hard landing in China and weakness in emerging markets likely to weigh on sentiment, however comments from this weekend's G20 finance ministers' meeting might improve business sentiment.

- Business prospect is however great with weaker Euro improving competitiveness of Euro area however domestic economies are facing some loss of momentum.

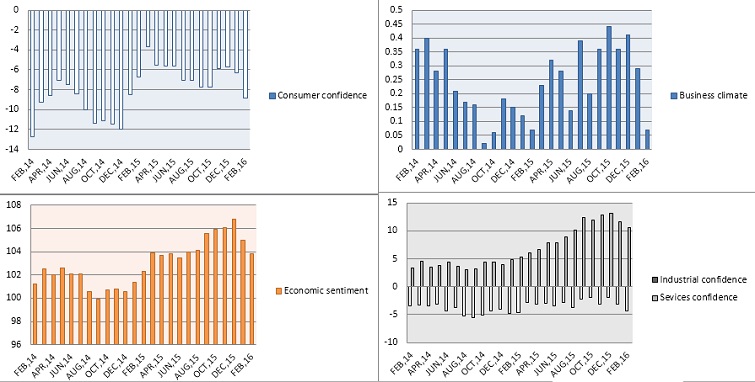

Today's economic survey showed that sentiment across Euro zone dropped sharply.

- Euro zone business climate dropped to 0.07 in February, lowest reading since February, 2015.

- Industrial confidence dropped to -4.4 lowest since February, 2015. Economic sentiment soured to 103.8, worst reading since May, 2015.

- Services sentiment dropped drastically to 10.6, lowest reading since August, 2015.

- Consumer confidence dropped to -8.8, worst reading since December, 2014.

Euro is currently trading at 1.102 against Dollar.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Japan’s Agricultural, Forestry and Fishery Exports Hit Record High in 2025 Despite Tariffs

Japan’s Agricultural, Forestry and Fishery Exports Hit Record High in 2025 Despite Tariffs  U.S. Stock Futures Rise as Investors Eye Big Tech Earnings and AI Momentum

U.S. Stock Futures Rise as Investors Eye Big Tech Earnings and AI Momentum  Taiwan Urges Stronger Trade Ties With Fellow Democracies, Rejects Economic Dependence on China

Taiwan Urges Stronger Trade Ties With Fellow Democracies, Rejects Economic Dependence on China  South Korea Inflation Hits Five-Month Low as CPI Reaches Central Bank Target

South Korea Inflation Hits Five-Month Low as CPI Reaches Central Bank Target  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade  Dollar Holds Firm as Strong U.S. Data, Fed Expectations and Global Central Bank Moves Shape Markets

Dollar Holds Firm as Strong U.S. Data, Fed Expectations and Global Central Bank Moves Shape Markets  Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding

Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding