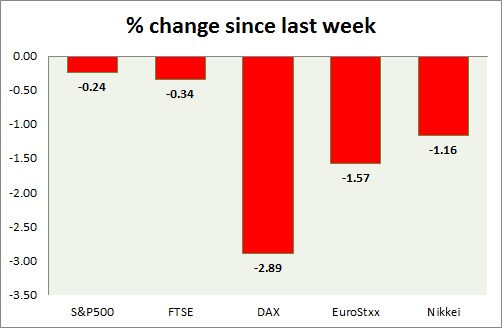

- S&P 500 - US benchmark fell in today's trading as markets growing tense over FED rate hike and strong dollar. Sellers are trying to break the key support level. Selloffs may further gather pace should the level gets broken. Producer price index fell by -0.5% mom. Michigan confidence deteriorated at 91.2 from previous 95.4. SPX500 is currently trading at 2044, down more than 1% for the day. Immediate support lies at 2040, 1985 and resistance 2068, 2081.

- FTSE - FTSE along with S&P 500 fell in today's trading. Further losses might occur as key support level remains broken. FTSE is trading at 6721, down 0.60% for the day. Price pattern suggests the index might fall as low as 6560. Support lies at 6690 and resistance near 6860.

- DAX - DAX is this week's star performers as it continues to remain favored by investors as ECB buys bonds. German economy remains robust too. DAX is currently trading at 11900, up nearly 1% for the day. Immediate support lies at 11720.

- EuroStxx50 - Stock performance is mixed across Europe. Investors continue to pour money in Europe. Germany is up (1%), France's CAC40 is up (0.45%), and Italy's FTSE MIB is down (-0.40%) whereas Spain's IBEX is up (0.10%). EuroStxx is currently trading at 3654, up 0.1% for the day. Support lies at 3555.

- Nikkei - Nikkei is today's best performer as risk aversion diminished. It surged more than 1.50% intraday but gave up some gains over profit booking. Nikkei has broken the resistance at 19000 and might move towards its target of 20,800. Immediate support lies at 19000, 18640.

|

S&P500 |

-1.30% |

|

FTSE |

-2.24% |

|

DAX |

3.39% |

|

EuroStxx |

1.47% |

|

Nikkei |

2.20% |

Robinhood Expands Sports Event Contracts With Player Performance Wagers

Robinhood Expands Sports Event Contracts With Player Performance Wagers  Asian Fund Managers Turn More Optimistic on Growth but Curb Equity Return Expectations: BofA Survey

Asian Fund Managers Turn More Optimistic on Growth but Curb Equity Return Expectations: BofA Survey  JPMorgan’s Top Large-Cap Pharma Stocks to Watch in 2026

JPMorgan’s Top Large-Cap Pharma Stocks to Watch in 2026