Dollar index trading at 96.15 (-0.09%).

Strength meter (today so far) - Euro +0.15%, Franc -0.30%, Yen -0.30%, GBP +0.67%

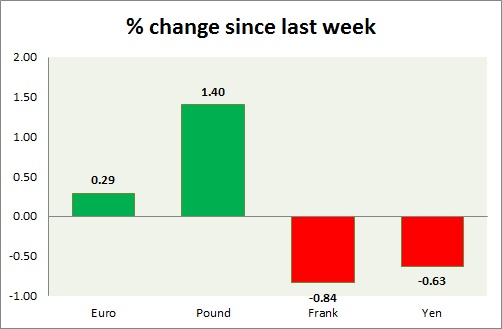

Strength meter (since last week) - Euro +0.29%, Franc -0.84%, Yen -0.63%, GBP +1.40%

EUR/USD -

Trading at 1.117

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.14, Short term - 1.132, Immediate - 1.122

Economic release today -

- Euro Zone GDP rose by 0.4% q/q in second quarter, up 1.5% from a year ago

Commentary -

- Euro traded as high as 1.123 against Dollar, however failed to break key resistance around that price. Likely to move further down.

GBP/USD -

Trading at 1.538

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512,

Resistance -

- Long term - 1.592-1.616, Medium term - 1.585, Short term - 1.543-1.545

Economic release today -

- NIL

Commentary -

- Pound is best performer today and this week so far. Amlin deal worth £ 3.5 billion provided some support. Active call - Sell Pound targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 119.8

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Sell

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 124.5

Economic release today -

- Eco watchers survey for current deteriorated to 49.3 in August from 51.6 prior, outlook deteriorated to 48.2 in August from 51.9 in July.

- GDP contracted by -0.3% in second quarter, better than expected 0.5%.

Commentary -

- Yen lost ground as equities rose, consolidating around 120 level. Active call - Sell USD/JPY targeting 114.7 area with stop loss around 122

USD/CHF -

Trading at 0.98

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.93

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- Swiss unemployment rate remained flat at 3.3% in August.

Commentary -

- Franc is the worst performer today as SNB keeps on selling Franc. Franc is the worst performer of the week.

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist  BTC Dips on Trade Tension Ease, But 450 BTC/Day Whale Says “Buy More” – Eyes $107K Glory

BTC Dips on Trade Tension Ease, But 450 BTC/Day Whale Says “Buy More” – Eyes $107K Glory  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Morgan Stanley Raises KOSPI Target to 5,200 on Strong Earnings and Reform Momentum

Morgan Stanley Raises KOSPI Target to 5,200 on Strong Earnings and Reform Momentum  Morgan Stanley Flags High Volatility Ahead for Tesla Stock on Robotaxi and AI Updates

Morgan Stanley Flags High Volatility Ahead for Tesla Stock on Robotaxi and AI Updates  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate