Dollar index trading at 94.71 (+0.14%)

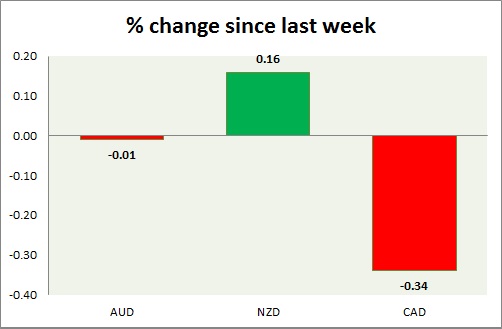

Strength meter (today so far) – Aussie +0.60%, Kiwi -0.36%, Loonie -0.47%

Strength meter (since last week) – Aussie +0.88%, Kiwi +0.64%, Loonie -0.05%

AUD/USD –

Trading at 0.726

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Buy

Support –

- Long term – 0.683, Medium term – 0.728, Short term – 0.728

Resistance –

- Long term – 0.82, Medium term – 0.79, Short term – 0.79

Economic release today –

- Westpac leading index declined -0.2%.

- Wage price rose just 0.4% in first quarter, up 2.1% from a year back, which is slowest since 1998.

Commentary –

- Aussie dropped sharply after poor wage growth data. Active call – Sell Aussie against Dollar @0.75 targeting 0.7 area, with stop loss around 0.785

NZD/USD –

Trading at 0.677

Trend meter –

- Long term – Sell, Medium term – Range, Short term – Range

Support –

- Long term – 0.56, Medium term – 0.62, Short term – 0.643

Resistance –

- Long term – 0.77, Medium term – 0.724, Short term – 0.724

Economic release today –

- NIL

Commentary –

- Kiwi is back declining over stronger Dollar.

USD/CAD –

Trading at 1.297

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Sell

Support –

- Long term – 1.19, Medium term – 1.22 , Short term – 1.25

Resistance –

- Long term – 1.334, Medium term – 1.32, Short term – 1.3

Economic release today –

- NIL

Commentary –

- Loonie failed to gain from oil price rise as wildfire has led to 2 million barrels/day supply cut.. Loonie is likely to gain further but more likely to consolidate in near term.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022