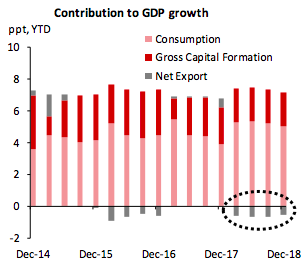

China’s real GDP growth fell further to 6.4 percent y/y in 4Q18 from 6.5 percent in 3Q18 as expected. Net export continued to drag the overall performance for the fourth straight quarter in spite of slumping oil price.

This largely mirrored the negative export growth in December after front-loading activities ended. The monthly data pointed to a grim outlook for 1Q19. Retail sales inched up to 8.2 percent y/y in December from 8.1 percent in November, staying at the lowest range since 1999.

Expenditure on most other discretionary goods such as cosmetics, jewellery, and automobile remained weak. Obviously, consumer confidence has been sapped by job insecurity and slower wage growth.

Fading credit impulse on the back of regulation tightening points to further weakness ahead. Infrastructure investment was a bright spot; growth was positive for a second consecutive month (5.7 percent in December vs 2.5 percent in November (3mma)).

The National Development and Reform Commission (NDRC) greenlighted RMB1.2 billion worth of infrastructure projects in 4Q18, the highest in three years.

"We expect the quota of special bond issuance (excluded from official budgets) to increase to RMB2 trillion in 2019 from RMB1.35 trillion last year. Off-budget expansions will likely include the re-launching of special construction fund," DBS Research commented.

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility