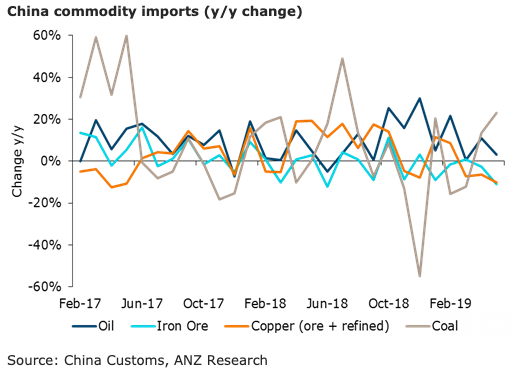

China’s commodities imports remained mixed during the month of May. While it is still too early to conclude if the renewed trade tensions have impacted imports in May, worsening trade relations between China and the US remain a key headwind for commodity demand.

Further, the country’s stimulatory measures are expected to potentially mitigate some of the demand concerns, according to the latest report from ANZ Research.

As expected, crude oil imports slowed following strong imports in April ahead of the removal of sanction waivers on Iranian oil. Tighter margins amid increased inventories of oil products have encouraged refiners to shut their plants for maintenance, and this kept crude oil demand weaker.

"We see tighter supplies and lower margins for refiners to keep imports lacklustre next month as well," the report added.

China’s refined copper imports stayed softer in May, while concentrate imports continued to rise by 16 percent y/y and 11 percent m/m. Lower prices and recovery in Chinese physical premium should keep imports strong next month.

Iron ore imports recovered following a steep drop in April, but are still down on a y/y basis as a result of the mine closures in Brazil and weather-related disruptions in Australia. However, diminishing stockpiles in Brazil could further weigh on exports. This will likely keep Chinese imports depressed in the short term, ANZ Research further noted.

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal