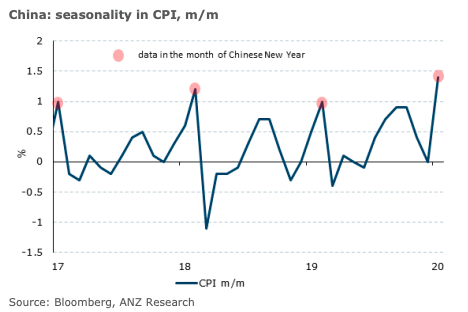

China’s consumer price inflation (CPI) for the month of January has overshot market expectations in January, partially due to the virus outbreak, because a 1.4 percent m/m spike is higher than the seasonal increases seen over the past three years.

According to the statistical practice, the prices of fresh farm products like vegetables, meat, and fruits are compiled every five days in the month. So the acceleration in food prices (4.4 percent m/m) reflects the impact of the novel coronavirus, ANZ Research reported.

Meanwhile, the prices of other goods and services are compiled less frequently and so are less affected by the outbreak. Although the headline PPI figure returned to positive territory in January, the continued uncertainty from the virus outbreak and subsequent deflationary risks facing Chinese factories will be concerning.

Geopolitical tensions in the Middle East had fuelled a jump in oil prices in early January, contributing to the increase in headline PPI (+4.3 percent m/m or 17.5 percent y/y). However, the virus outbreak has dampened commodity prices, with Brent crude dropping more than 20 percent over the past two weeks.

"We expect China’s PPI to turn negative in February, exerting downward pressure on industrial activities in H1 2020," the report added.

The probability of another cut in the 7-day reverse repo is low, as the People’s Bank of China (PBoC) will place emphasis on financial stability and efforts to contain the virus via liquidity injections and re-lending.

Meanwhile, the rate cut made on February 3 is an act of front-loading, more to restore market confidence rather than counter-cyclical adjustment. It would be interesting to see if the PBoC will cut the reserve requirement ratio (RRR) to support the banking sector, ANZ Research further noted in the report.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility