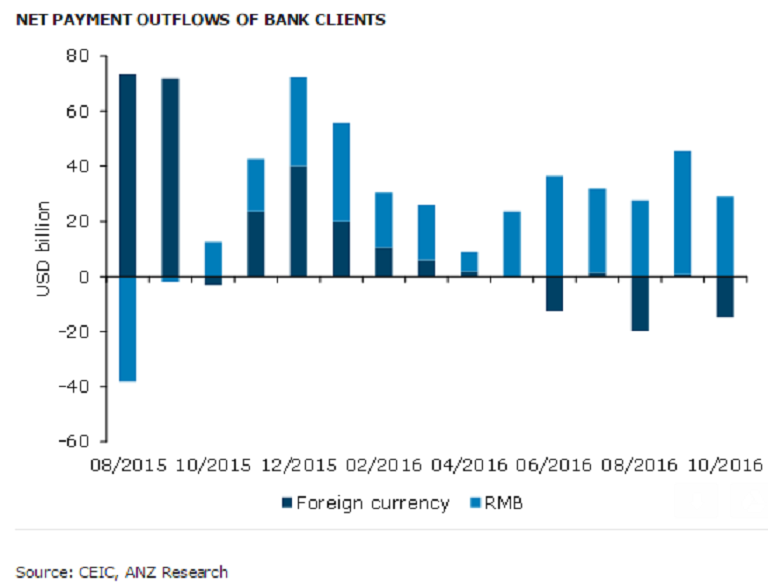

Capital outflows from China have increased over the past few months, averaging to SD24 billion a month since May. But the net payments are dominated in RMB instead of in the USD. In fact, banks report net receipts in foreign currency (mostly in USD). This is consistent with the decline in foreign exchange buying by banks' clients (October: -20 percent y/y) in the onshore market.

Chinese regulators will tighten the capital flows in yuan and foreign exchange operations of local financial institutions. As onshore buying of foreign currency becomes increasingly difficult, Chinese residents will be encouraged to send funds in the local currency for conversion abroad. Thus the offshore market will face stronger yuan depreciation pressure. This may trigger some regulatory actions to tighten the RMB outflows, ANZ reported.

The policy stance of China's central bank seems to have shifted from directly managing the exchange rate to preserving foreign reserves. On one hand, the central bank has adopted the policy to adjust RMB exchange rate with reference to a basket of currencies.

The People's Bank of China (PBoC) seems to have a higher tolerance for exchange rate flexibility and allow the yuan to weaken in light of USD strengthening. On the other hand, the State Council is reportedly tightening overseas investment activities and acquisitions of Chinese enterprises. The authorities seem to be targeting the quantity of cross border flows.

"In our view, China should strengthen the use of interest rate instruments to influence the yuan exchange rate indirectly if the country continues to commit to capital account liberalization," the report said.

Meanwhile, the USD/CNY currency pair has formed a bearish engulfing pattern at 6.88, down 0.22 percent and having support at 6.85-6.87, while resistance is maintained at 6.89-6.91.

Gold Prices Pull Back After Record Highs as January Rally Remains Strong

Gold Prices Pull Back After Record Highs as January Rally Remains Strong  U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster

U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster  Indonesian Stocks Plunge as MSCI Downgrade Risk Sparks Investor Exodus

Indonesian Stocks Plunge as MSCI Downgrade Risk Sparks Investor Exodus  Wall Street Slides as Warsh Fed Nomination, Hot Inflation, and Precious Metals Rout Shake Markets

Wall Street Slides as Warsh Fed Nomination, Hot Inflation, and Precious Metals Rout Shake Markets  U.S. and El Salvador Sign Landmark Critical Minerals Agreement to Boost Investment and Trade

U.S. and El Salvador Sign Landmark Critical Minerals Agreement to Boost Investment and Trade  Trump Threatens 50% Tariff on Canadian Aircraft Amid Escalating U.S.-Canada Trade Dispute

Trump Threatens 50% Tariff on Canadian Aircraft Amid Escalating U.S.-Canada Trade Dispute  China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook

China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook  Asian Currencies Trade Flat as Dollar Retreats After Fed Decision

Asian Currencies Trade Flat as Dollar Retreats After Fed Decision  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons