In 2021, an investment firm bought 2,000 acres of real estate for about US$4 million. Normally this would not make headlines, but in this case the land was virtual. It existed only in a metaverse platform called The Sandbox. By buying 792 non-fungible tokens on the Ethereum blockchain, the firm then owned the equivalent of 1,200 city blocks.

But did it? It turns out that legal ownership in the metaverse is not that simple.

The prevailing but legally problematic narrative among crypto enthusiasts is that NFTs allow true ownership of digital items in the metaverse for two reasons: decentralization and interoperability. These two technological features have led some to claim that tokens provide indisputable proof of ownership, which can be used across various metaverse apps, environments and games. Because of this decentralization, some also claim that buying and selling virtual items can be done on the blockchain itself for whatever price you want, without any person or any company’s permission.

Despite these claims, the legal status of virtual “owners” is significantly more complicated. In fact, the current ownership of metaverse assets is not governed by property law at all, but rather by contract law. As a legal scholar who studies property law, tech policy and legal ownership, I believe that what many companies are calling “ownership” in the metaverse is not the same as ownership in the physical world, and consumers are at risk of being swindled.

Purchasing in the metaverse

When you buy an item in the metaverse, your purchase is recorded in a transaction on a blockchain, which is a digital ledger under nobody’s control and in which transaction records cannot be deleted or altered. Your purchase assigns you ownership of an NFT, which is simply a unique string of bits. You store the NFT in a crypto wallet that only you can open, and which you “carry” with you wherever you go in the metaverse. Each NFT is linked to a particular virtual item.

It is easy to think that because your NFT is in your crypto wallet, no one can take your NFT-backed virtual apartment, outfit or magic wand away from you without access to your wallet’s private key. Because of this, many people think that the NFT and the digital item are one and the same. Even experts conflate NFTs with their respective digital goods, noting that because NFTs are personal property, they allow you to own digital goods in a virtual world.

NFTs and the hype about the metaverse have sparked a virtual land rush.

However, when you join a metaverse platform you must first agree to the platform’s terms of service, terms of use or end user license agreement. These are legally binding documents that define the rights and duties of the users and the metaverse platform. Unfortunately and unsurprisingly, almost no one actually reads the terms of service. In one study, only 1.7% of users found and questioned a “child assignment clause” embedded in a terms of service document. Everyone else unwittingly gave away their first-born child to the fictional online service provider.

It is in these lengthy and sometimes incomprehensible documents where metaverse platforms spell out the legal nuances of virtual ownership. Unlike the blockchain itself, the terms of service for each metaverse platform are centralized and are under the complete control of a single company. This is extremely problematic for legal ownership.

Interoperability and portability are defining features of the metaverse, meaning you should be able to carry your non-real-estate virtual property – your avatar, your digital art, your magic wand – from one virtual world to another. But today’s virtual worlds are not connected to one another, and there is nothing in an NFT itself that labels it as, say, a magic wand. As it stands, each platform needs to link NFTs to their own proprietary digital assets.

Virtual fine print

Under the terms of service, the NFTs purchased and the digital goods received are almost never one and the same. NFTs exist on the blockchain. The land, goods and characters in the metaverse, on the other hand, exist on private servers running proprietary code with secured, inaccessible databases.

This means that all visual and functional aspects of digital assets – the very features that give them any value – are not on the blockchain at all. These features are completely controlled by the private metaverse platforms and are subject to their unilateral control.

Because of their terms of service, platforms can even legally delete or give your items away by delinking the digital assets from their original NFT identification codes. Ultimately, even though you may own the NFT that came with your digital purchase, you do not legally own or possess the digital assets themselves. Instead, the platforms merely grant you access to the digital assets and only for the length of time they want.

For example, on one day you might own a $200,000 digital painting for your apartment in the metaverse, and the next day you may find yourself banned from the metaverse platform, and your painting, which was originally stored in its proprietary databases, deleted. Strictly speaking, you would still own the NFT on the blockchain with its original identification code, but it is now functionally useless and financially worthless.

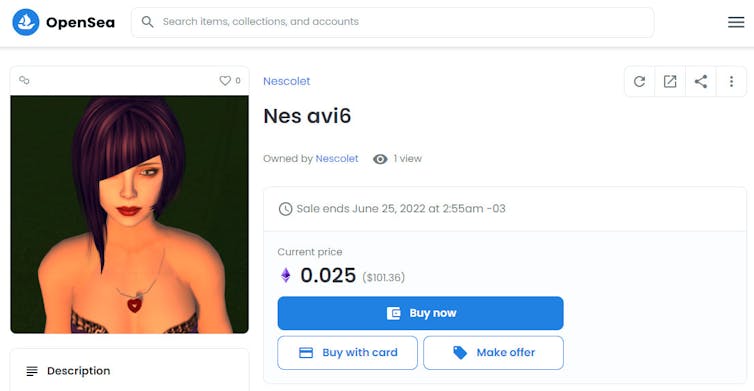

Virtual items like this avatar are sold in NFT marketplaces. Nescolet/Flickr, CC BY-NC-ND

While admittedly jarring, this is not a far-fetched scenario. It might not be a wise business move for the platform company, but there’s nothing in the law to prevent it. Under the terms of use and premium NFT terms of use governing the $4 million’s worth of virtual real estate purchased on The Sandbox, the metaverse company – like many other NFT and metaverse platforms – reserves the right at its sole discretion to terminate your ability to use or even access your purchased digital assets.

If The Sandbox “reasonably believes” you engaged in any of the platform’s prohibited activities, which require subjective judgments about whether you interfered with others’ “enjoyment” of the platform, it may immediately suspend or terminate your user account and delete your NFT’s images and descriptions from its platform. It can do this without any notice or liability to you.

In fact, The Sandbox even claims the right in these cases to immediately confiscate any NFTs it deems you acquired as a result of the prohibited activities. How it would successfully confiscate blockchain-based NFTs is a technological mystery, but this raises further questions about the validity of what it calls virtual ownership.

The Conversation reached out to The Sandbox for comment but did not receive a response.

Legally binding

As if these clauses weren’t alarming enough, many metaverse platforms reserve the right to amend their terms of service at any time with little to no actual notice. This means that users would need to constantly refresh and reread the terms to ensure they do not engage in any recently banned behavior that could result in the deletion of their “purchased” assets or even their entire accounts.

Technology alone will not pave the way for true ownership of digital assets in the metaverse. NFTs cannot bypass the centralized control that metaverse platforms currently have and will continue to have under their contractual terms of service. Ultimately, legal reform alongside technological innovation is needed before the metaverse can mature into what it promises to become.

João Marinotti does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

João Marinotti does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

João Marinotti, Associate Professor of Law, Indiana University

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers