The South African budget data for January that was published yesterday once again confirmed the urgent need to consolidate public finances. The seasonally adjusted data illustrated a budget gap of approx. ZAR 41bn., thus recording a mom rise. After the new finance minister Nhlanhla Nene was sworn in on Tuesday he had pointed out that the government was already in talks with the rating agencies. But it remains to be seen whether they will accept the consolidation efforts presented in last week’s budget or whether they demand additional changes.

The outlook for the current account deficit that had fallen as a result of improved trade balance data over the course of 2017 also deteriorated recently. The strong rand made imports cheaper while exports became more expensive. The volatile data recorded a significantly higher deficit of just under ZAR 28bn. for January. Following the publication of the data, USDZAR appreciated slightly and traded at levels around 11.80 in the end.

While rates positioning already shows as high, we still see some positioning scope on lower FX hedging behavior. Overall we would guess we are 70-80% with the positioning build up. The recent client survey shows that investors extended their overweight rates positions for a third consecutive month in February. Long SAGB positions are now largest overweight in EMEA EM, recently replacing long OFZ positions (refer 2nd chart).

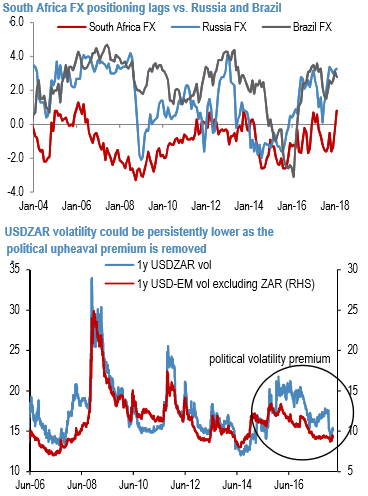

However, compared to Brazil, which also underwent a period of political change, there is perhaps some further room to extend overweight rates positions. Importantly, FX positioning lags substantially vs. Russia or Brazil (refer 1st chart). This is indicative of traditionally higher FX hedge ratios on real money holdings in South Africa compared to other markets. However, this could now also change to some extent:

We believe there is a case for sustainably lower FX volatility as the political risk premium embedded in ZAR since 2015 fades (1st chart). Courtesy: JPM

Currency Strength Index: FxWirePro’s hourly USD spot index has shown 48 (which is bullish ahead of US unemployment claims and Fed chief Powell’s testimony) while articulating (at 12:35 GMT), for more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand