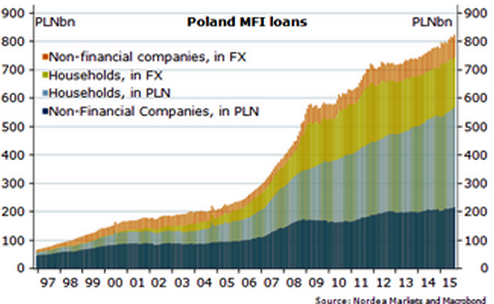

A forced CHF-denominated mortgage loan(the Swiss franc lending) conversion is to be the hottest topic in Poland at the moment. Two proposals have been out on forcing banks to convert a total portfolio of 37bn CHF-denominated housing loans (PLN 142bn ~8% of expected 2015 GDP) to PLN-denominated loans.

The general view in Poland is that such a conversion would be politically motivated, not economically. A forced CHF loan conversion scheme does not become a reality after the election, but the risk is there.

CHF-denominated loans have been taken by the wealthiest and are with floating rates, lower CHF Libor rates almost compensated for the FX loss when it comes to repayments, therefore the share of non-performing loans (NPL) is very low.

Loan-to-value (LTV) ratios are high, though. The CHF-loan portfolio is not equally distributed among banks and thus some banks could be in trouble in the current suggestion. Banks are fully hedged on their CHF loan books and a forced conversion would mean that a lot of hedges via long cross currency swaps would have to be bought back, leading to a clear weakening of the PLN.

"The NBP could be forced to use FX reserves to neutralise the impact on the PLN from a forced conversion, as it was the case in Hungary when a similar scheme was implemented. Alternative suggestions to a CHF-conversion have been a bank tax or a financial transaction tax. Such taxes would generate much less revenue to finance the next government's election promises, but seem much more likely", says Nordea Bank.

CHF-loans are a risk, but forced conversion to PLN most unlikely to happen

Wednesday, September 30, 2015 5:13 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022