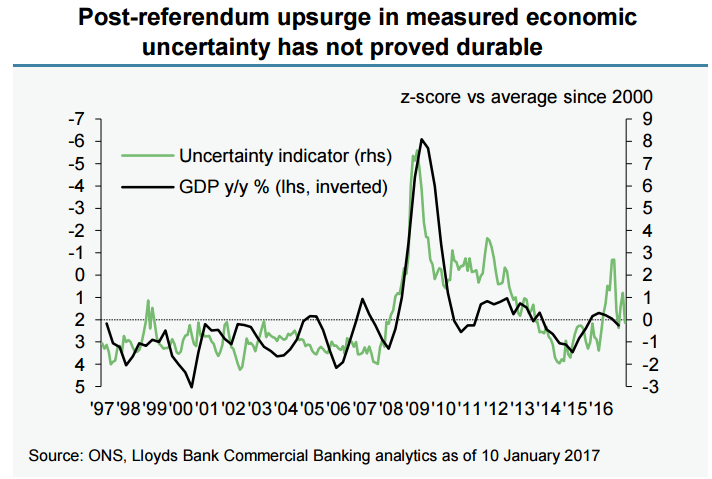

Incoming economic data in UK do not support the view of an uncertainty driven slowdown in the aftermath of the EU referendum. UK economy expanded at 0.6 percent q/q in Q3 2016, the first full post-referendum quarter. The economy’s dominant services sector saw a brisk 1.0 percent q/q growth in Q3.

Composite PMI in December spanning across the manufacturing, construction and services sectors stood at its strongest since July 2015. Survey data for Q4 have also been solid and analysts expect overall GDP growth in Q4 could post a 0.5 percent q/q rise. Together with the recent history of GDP data, that would leave growth in the six months since the referendum, in fact, quicker than in the first half of 2016. And the apparent resilience towards the end of 2016 suggests that some of this momentum is likely to carry over into H1 2017.

Inflation in the UK is likely to rise through 2 percent target by spring 2017 as currency weakness drives import price rises. The coming few months are likely to see a sharp rise in the headline inflation rate on the back of significant impact from energy price base effects and as the exchange rate pass-through becomes dominant.

"We expect CPI inflation to tick up further to 1.3% by December and burst through the 2% target by spring 2017. Easing underlying cost pressures from the second half of 2017 should provide some offset as growth in the economy slows modestly and reduced labour market tightness limits inflation’s overshoot relative to target." said Lloyds bank in a report.

As exit negotiations with the European Union begin, how measures of uncertainty evolve over the coming months and how strong the mapping proves with official activity data are among the key questions for the near-term outlook. The deceleration of economic activity over the course of 2017 and 2018 is likely to principally result from the weakness of sterling.

UK Monetary Policy Committee (MPC) is likely to look through inflation rise, but could react if activity slowdown proves more modest than expected. "Our base scenario sees Bank Rate on hold for the foreseeable future, but with a skew towards tighter policy," adds Lloyd's Bank in a report.

GBP/USD tests 1.21, weakest since Oct 7 'flash crash'. Cable continued slump as Hard-Brexit concerns continued to weigh on the investors’ sentiment. EUR/GBP spiked beyond 0.8750 to hit fresh multi-week highs at 0.8763.

FxWirePro Currency Strength Index showed Hourly GBP Spot Index at -91.9716 (Highly Bearish) at 1130 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan