Bank Indonesia (BI) kept its benchmark 7-day reverse repo rate steady at 4.75 percent on Thursday, as widely expected. Indonesia's central bank held rates unchanged for the sixth consecutive meeting and said that the current level was supportive of efforts to maintain macroeconomic and financial stability.

BI also kept the deposit facility and lending facility rates, which act as the floor and ceiling of the overnight interbank money market, unchanged at 4.00 percent and 5.50 percent, respectively. The central bank cut its benchmark rate six times last year by a total of 150 basis points and eased some lending regulations to help boost growth.

Despite the numerous rate cuts by the central bank, the rupiah has actually strengthened on nominal effective exchange rate (NEER) basis. Arguably, a stable or stronger rupiah is a boost to growth momentum, given the positive impact it has on domestic investment.

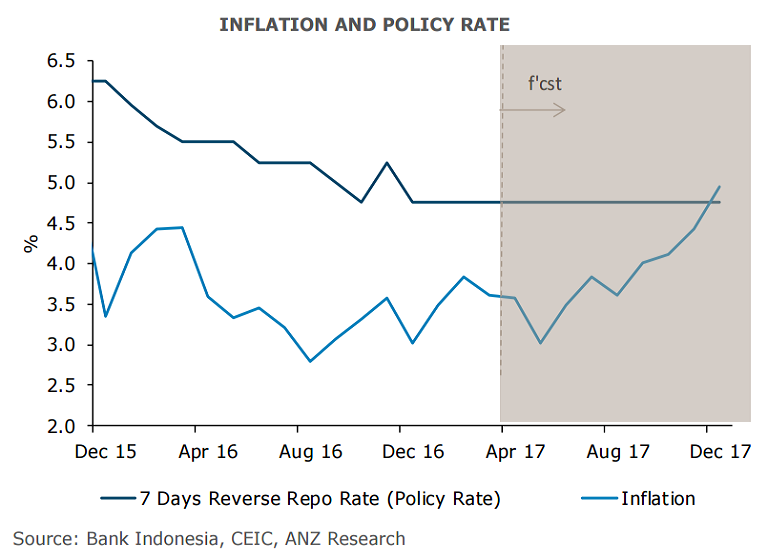

Indonesia's growth has been stuck in the 5-5.5 percent range, a level that corresponds to stable demand pull inflation. Inflationary pressures have abated as the final electricity tariff hike has been postponed to at least until June. It also appears that the government has been proactive in ensuring that prices for basic goods and services are contained which is evident from the m/m decline in food and transportation costs.

Indonesia's economic growth in the first quarter of 2017 is predicted to remain well even below its initial estimate. Economic growth is forecasted to increase in Q2 / 2017, buoyed by improved investment and exports, while consumption is expected to be relatively stable. Meanwhile, improving commodity prices and strengthening demand related to the global economic recovery are expected to boost export and investment performance. Going forward, the role of fiscal stimulus is expected to be maintained in promoting economic growth.

"With growth likely to be in the 5-5.5% range, demand-pull inflationary pressures should remain in check. Coupled with tightening by the U.S. Federal Reserve, the macro backdrop suggests that BI will remain on hold through 2017," said ANZ in a report.

USD/IDR was trading at 13295 at around 1120 GMT. The pair finds stiff resistance at 50-DMA at 13322. Daily Ichimoku cloud also weighs on the upside. Price action has been range bound since the beginning of 2017. Only break above daily cloud could see some upside. FxWirePro's Hourly USD Spot Index was at 47.6941 (Neutral) at 1130 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.