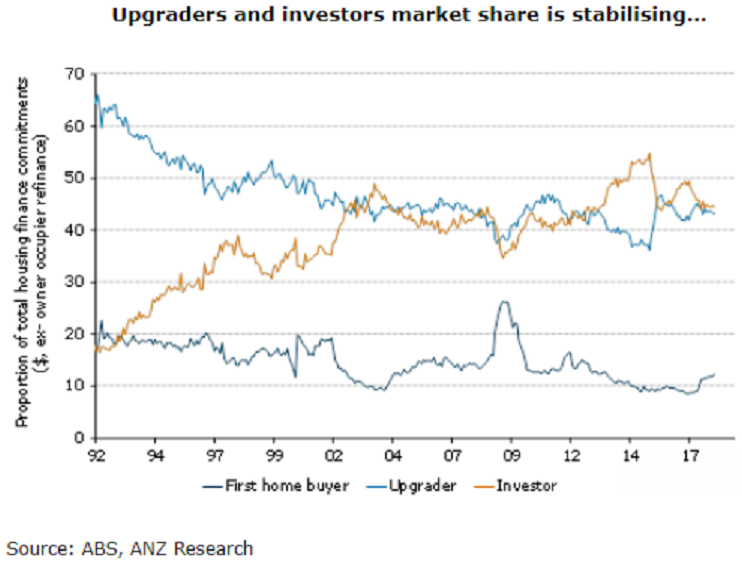

Australia’s value of new housing finance approvals rose again in February, with growth across all sectors. The increasing presence of first home buyers is driving strength in the owner-occupier segment, while investor borrowing appears to have finished its earlier decline.

The value of Australia’s housing finance commitments rose by another 1.0 percent m/m. This pushed annual growth back into positive territory (albeit only just), providing further evidence that housing finance is stabilizing.

The monthly increase was driven by the owner-occupier segment, which rose 1.4 percent m/m. Investors were up a more subdued 0.5 percent m/m, following from the 1.4 percent m/m rise in January. This is the first time in nearly 18 months that investor borrowing has posted consecutive increases.

Underpinning the rise in owner-occupier borrowing was another solid increase in first home buyer activity. First home buyer lending is up more than 40 percent over the past year, and accounted for 12.4 percent of all housing finance in February.

"That is the highest share of borrowing in nearly five years. From the perspective of getting first home buyers into the market, the NSW and Victorian state governments’ stamp duty incentives are working a charm," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns