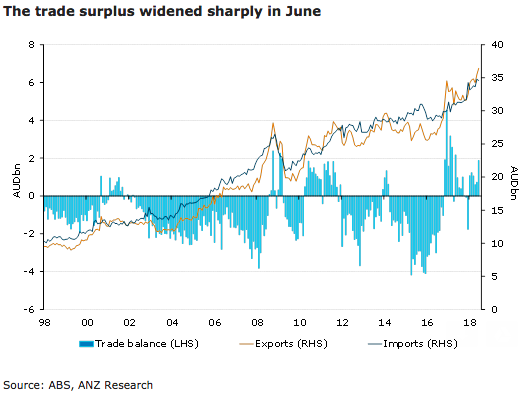

Australia’s trade surplus for the month of June beat market expectations, even after a slight downward revision to May’s surplus. Despite the strength in export values in the month of June it looks like net exports are set to have made no contribution to GDP growth in Q2, according to the latest report from ANZ Research.

The monthly trade balance widened to AUD1,873 million in June – the widest surplus since May 2017. The previous month’s surplus was revised down slightly to AUD725 million (from AUD827 million originally). June’s improvement reflected monthly export growth of 2.6 percent, while imports fell 0.7 percent.

Total export values rose by 2.6 percent m/m, leaving them 12.9 percent higher an on annual basis. The fastest gains were seen in manufacturing goods (4.9 percent m/m), with transport equipment rising 16.4 percent m/m. Rural goods rose 4.6 percent m/m led by a 10 percent m/m increase in exports of cereal grain and cereal preparations.

Total import values fell by 0.7 percent m/m in June, following a 3.4 percent increase in May. In annual terms imports are up 10.4 percent in value terms. The biggest drags on total imports were fuels (-10.8 percent m/m) and the volatile non-monetary gold segment (-14.9 percent m/m).

Imports of intermediate and other merchandise goods fell 3.6 percent, with parts for transport equipment down 5.4 percent and iron and steel down 5.9 percent. Consumption goods were down 0.2 percent, with non-industrial transport equipment down 3.3 percent and food and beverages up 2.2 percent. Capital goods rose, led by a 13 percent increase in civil aircraft.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk