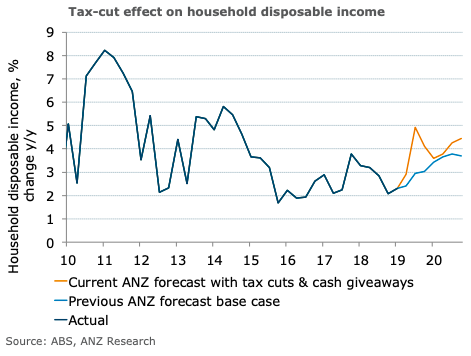

Australia’s tax cuts is expected to boost household consumption in the September and December quarters by approximately $7.2 billion; as returns vary in timing; a slower and more spread-out pattern of spending growth is likely, according to the latest report from ANZ Research.

Tax cuts are arriving in the form of tax refund payments from July. While there is some uncertainty around the timing of the legislation that will approximately double the already approved tax cut, the boost to Australian households might be considerable. There are also some one-off payments to households.

This could materially impact consumer spending over the rest of 2019. Because the proposed tax cuts would be delivered in a lump sum with tax returns, the household income and spending boost is likely to concentrate in the second half of 2019, the report added.

Like the post-GFC bonuses, the proposed tax cuts will be delivered as one sum, which generally leads to shorter-term spikes in spending. The key difference being that they would be delivered through tax returns, rather than automatic bonus payments.

So household use of tax cut will be spread out over the second half of 2019, whereas the post GFC was more concentrated. This will likely mean the impact on the data is more diffuse.

"Over the last ten years, however, Australian households have changed. We are more indebted and our non-discretionary expenses are higher; we spend more on travel and less on retail. And this may affect how we spend, this time around," ANZ Research further added in its comments.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices