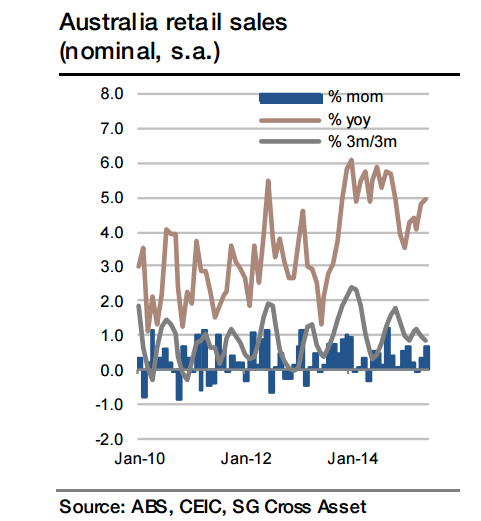

Australia's retail sales surprised on the upside in June with a 0.7% mom gain, despite a marginal (0.1%) decline in food sales, meaning that non-food sales jumped by 1.2% mom, their largest gain since January (food sales account for just over 40% of the total). Given the moderate gains in disposable income (2.6% yoy in Q1), retail sales growth of just short of 5% is unlikely to be sustained for long.

Hence, a moderate pull-back is expected in July non-food sales (-0.1% mom), which combined with a 0.5% rebound in food sales, implies a marginal 0.1% mom gain in overall sales. The weakness is likely to be concentrated in sales of household goods, which have seen an impressive run over the past year, partly on the back of the housing boom. One key downside risk comes from department store sales, which have in recent years seen dramatic volatility in July/August (with steep declines in July and August rebounds), though this did not occur in 2014.

Australia's retail sales consolidating after autumn surge

Monday, August 31, 2015 1:53 AM UTC

Editor's Picks

- Market Data

Most Popular

9

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy