Australia’s Capex fell slightly in Q3, although this was somewhat tempered by the upgrade to the Q2 result, from -2.5 percent q/q to -0.9 percent q/q. Further, outside of the weakness in construction, the details of the report were positive.

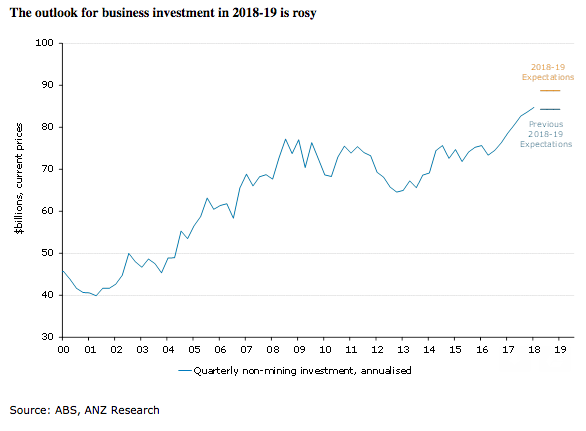

In even better news, the outlook for 2018-19 was revised materially higher. This is important because this release is where firms’ forecasts traditionally become much more accurate.

Non-mining firms now expect their investment to increase 7 percent over the current financial year, which is a much better outcome than the 2 percent growth forecast three months ago.

Even the mining sector is slowly turning around. Gas and oil investment fell a further 8 percent in Q3, likely driven by the Ichthys project fast approaching completion. But iron ore investment rose again, with spending in Q3 more than 50 percent above the Q2 2017 trough.

"Further, mining firms expect investment to fall by just 1 percent in 2018-19, which would be the best result since 2012-13," ANZ Research commented in its latest report.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns