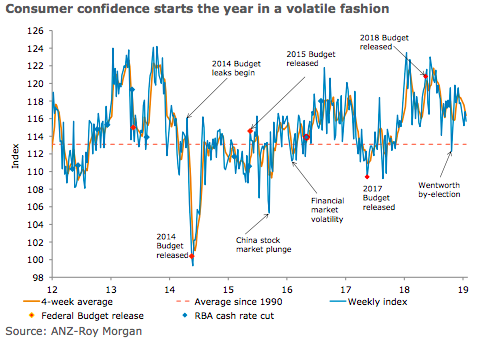

Australia’s ANZ-Roy Morgan consumer confidence was down 0.9 percent last week, giving back much of the prior week’s gain. The overall index is still above its starting point for 2019, though it is almost 5 percent lower than its average for January 2018.

Financial conditions declined, with current and future financial conditions falling by 0.3 percent and 2.4 percent respectively. Both indices are around the levels seen this time last year and above long-run averages.

Economic conditions were mixed, with current economic conditions gaining 3.4 percent while future economic conditions fell 0.7 percent. These indices are 6–8 percent below the levels that prevailed in January 2018. The ‘time to buy a household item’ index fell 3.2 percent. Four-week moving average inflation expectations declined by 0.1ppt to 4.2 percent.

"It has been a volatile start to the year for consumer sentiment, with the index displaying a down-up-down pattern, though encouragingly it remains above the long-run average. The global news is not helping, with China slowing and political developments in the UK and US dispiriting. Domestically the focus remains on the weak housing market, though as we noted in Friday’s Australian Macro Weekly the evidence of a wider negative impact is still quite limited. Employment will be the key domestic data event this week," said David Plank, ANZ’s Head of Australian Economics.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022