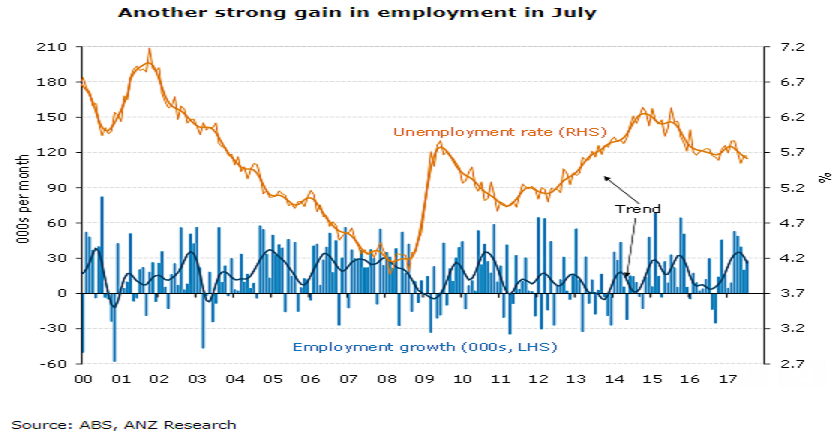

Australia posted another strong labour market report for Australia in July, showing employment up 28k and unemployment at 5.6 percent. Some of the detail was a bit softer than the headline; full-time jobs fell, hours worked were down and the jobs gains were narrowly based.

Employment rose 27.9k in July, building on the strength of the past few months. The unemployment rate printed at 5.6 percent, down a tick from an upwardly revised 5.7 percent in June. The strength was narrowly based geographically, with Queensland (+27k) accounting for nearly all the jobs growth. NSW employment rose very modestly (+0.5k) while employment in Victoria (-2.2k), Western Australia (-1.3k) and Tasmania (-2.2k) fell.

While the recent improvement in the labour market is an encouraging sign for the RBA, and business surveys suggest some near term downside risk to the unemployment rate, further material inroads into the unemployment rate look likely to be more difficult to achieve over the next year or so, particularly if housing construction slows as we expect and the pace of public sector jobs growth slows.

"Underemployment looks to be unchanged in the month. Our rough seasonal adjustment of the ABS monthly series suggests that underemployment remained at 8.4 percent in July, in line with June but well down from its peak of 8.9 percent in February," ANZ Research commented in its latest report.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market